John Bogle has in the news of late, including here on Abnormal Returns. Many investors believe that the tenets emphasize by Bogle over time including indexing and diversification have gone by the wayside.

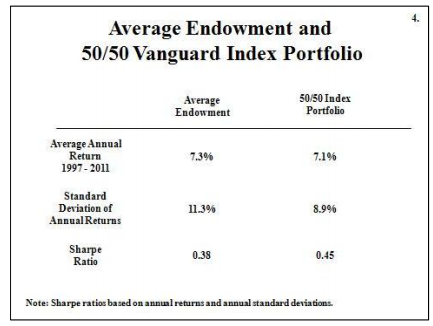

Jame Picerno at The Capital Spectator recently wrote up a summary of a speech that Bogle recently gave to NACUBO i.e. The National Association of College and University Business Officers. In this speech Bogle revisits the performance of a really simple portfolio that includes 50% equities and 50% bonds against the average peformance of college endowments. The following were the results:

Source: JohnCBogle.com

There is no doubt that much time, effort and money was spent trying to generate the returns at the nation’s endowment funds. In addition there are certainly some funds, like Yale and Harvard, that have handsomely outperformed over this time period. However a reasonably long time period the most simple portfolio imaginable performed as well or better than most funds.

I have often written that a sub-optimal portfolio strategy is superior to a strategy that cannot be followed. A 50/50 portfolio, rebalanced quarterly, is about simple as things get. This yet another example why most investors would be well served by doing very little with their portfolio as opposed to too much.

Items worth reading in their entirety:

A 15-year review. (Capital Spectator)

The Lessons of History – Endowment and Foundation Investing Today (John C. Bogle)

Is John Bogle a dinosaur? (Abnormal Returns)