There has been a great deal of discussion on the effect of super-low interest rates on pension funds. Not only the discount rate side where lower interest rates translate into a higher present value of liabilities, but also on the return expectation side. For example, CALPERS is still projecting 7.75% long term average returns in a world of 2% 10-year Treasury yields.

A recent report by James Moore at Pimco shows just that over the past few year pension funds have come to rely on ever higher return expectations on risk assets. Moore writes:

In the early nineties, plan sponsors, if biased in their forecast, were generally biased toward conservatism. From 1997 through 2007, expectations, although a bit rosy at times, were largely within the realm of reasonableness. In our view, a long-run equity risk premium of 11% is pure jibber-jabber. It is wishful thinking. I dare not predict the level of the S&P 500 ten years out, but an ERP this high suggests the S&P would have to reach unprecedented levels. If this is what plan sponsors are counting on, I, like Clubber Lang, predict Pain.

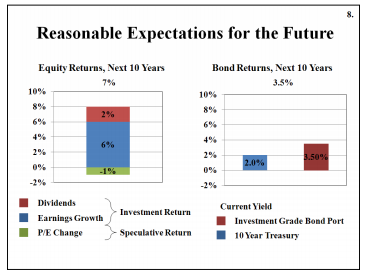

Individual investors are not pension funds, but having some sense for what the markets imply for longer term average returns can help in setting expectations and planning purposes. About little while ago John Bogle presented return expectations for stocks and bonds or 7% and 3.5% that both fall well below the 7.75% hurdle.

Source: JohnCBogle.com

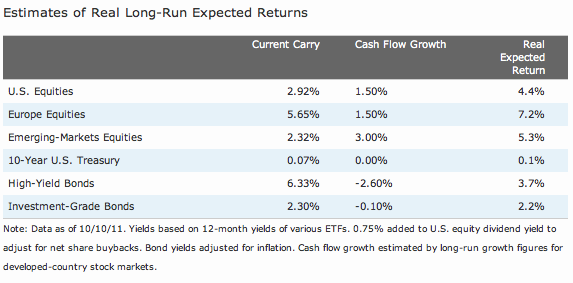

In a post today Samuel Lee at Morningstar took a look a broader array of asset classes. The results here are a little better with real expected returns for European and emerging market equities at or above (depending on your inflation forecast) the CALPERS hurdle rate. Fixed income remains a real drag on future returns.

Source: Morningstar.com

All of these estimates are exactly that, estimates. The future can play out in any number of ways. However the age of double digit returns of the 1980s and 1990s are long since past. A prudent investor or fiduciary should be thinking very hard about bringing their return expectations into line with a more muted future.

Items mentioned above:

Are 7.75% target returns feasible for large pension funds? (Humble Student of the Markets)

Pension plans are expecting more from their risk assets. (Pimco via Zero Hedge)

Just because you index does not mean you should ignore valuations. (Morningstar)

Dissecting the historical equity risk premium for clues about the future. (Capital Spectator)

Equity premia around the world. (SSRN)

The Lessons of History – Endowment and Foundation Investing Today (John C. Bogle)

[repeat] In praise of doing very little. (Abnormal Returns)