Quote of the day

Eli Radke, “Experience does not mean you do not have to do the work, it means that the work pays more dividends.” (Trader Habits)

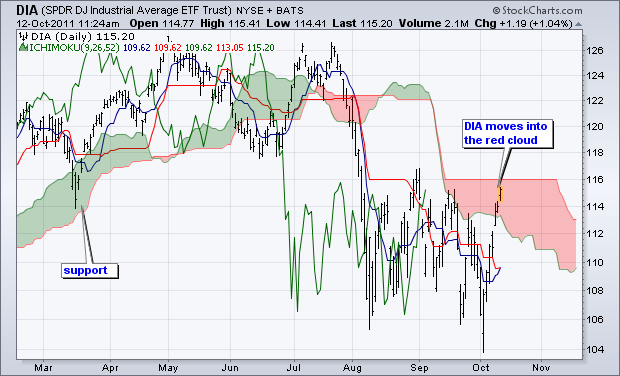

Chart of the day

The Dow moves into the “red cloud.” (StockCharts Blog)

Markets

Random government intervention makes handicapping the markets difficult. (Kid Dynamite)

Example #521: outsmarting the market is hard. (CBS Moneywatch)

Where did all the stock gurus go? (Moneywatch)

Semiconductors are rapidly reaching a key level. (All Star Charts)

The end of portfolio diversification: the case of oil. (FT Alphaville)

Brent crude gets a boost in the Dow Jones-UBS indices. (FT)

How long can TIPS yields essentially at 0% yields. (Calafia Beach Pundit)

Strategy

Notes from the Big Picture Conference. (Stock Sage)

Why traders should learn to program. (Bigger Capital)

Roger Nusbaum, “Broken or not this is world we live in.” (Random Roger)

The opportunity in the E&P names. (Breakingviews)

Volatility

Shorting the $VXX is not as easy at it seems. (Adam Warner)

Another look at recent market volatility. (AlphaTrends)

A look at the “volatility compression.” (Adam Grimes)

Tired of trading the same old stuff? Try trading realized volatility. (Points and Figures)

Companies

HP ($HPQ) is rethinking spinning off its PC business. (WSJ, 24/7 Wall St.)

Wal-Mart ($WMT) is rallying. Is that a good or bad thing? (Fund My Mutual Fund)

A long look back at PepsiCo ($PEP). (Crossing Wall Street)

Groupon and Zynga should have gotten their numbers right before filing for IPOs. (Dealbook, BI)

Benford’s law and the decreasing reliability of US accounting data. (Studies in Everyday Life via EV also Marginal Revolution)

Apple

Wall Street still does not understand Apple ($AAPL). (Apple 2.0)

What is next for Apple? (Matt Mullenweg via Om)

What to look for in iOS 5. (SplatF)

Finance

Check out the decline in financial CDS prices. (SurlyTrader)

The poor track record of companies in buying back their shares. (WSJ)

What it takes to be a systematically important non-bank these days. (NYTimes, FT, MarketBeat)

Why it takes longer to bring an actively managed ETF to market. (Ignites)

Do investors really care where their hedge fund gets its hires? (Dealbreaker)

Do we really want whistleblowers to get really rich? (Felix Salmon)

Economy

The world economy in one graphic. (Money Game)

Diesel fuel consumption continues to wane. (Calculated Risk)

A look at recent JOLTS data. (Economic Intersection. Economix)

Are workers too productive? (The Atlantic)

If a recession is nigh, policy makers have no chance of averting it. (Economist’s View)

Earlier on Abnormal Returns

Setting return expectations in an age of single digit returns. (Abnormal Returns)

What you missed in our Wednesday morning linkfest. (Abnormal Returns)

Mixed media

On the importance of content for e-commerce. (SplatF)

A rave review for Daniel Kahneman’s new book, Thinking, Fast and Slow![]() .* (Marginal Revolution)

.* (Marginal Revolution)

Abnormal Returns is a founding member of the StockTwits Blog Network.

*Amazon affiliate. You know the drill.