Quote of the day

Felix Salmon, “Greece can fall and the eurozone can still survive. But Italy — which is just as politically dysfunctional as Greece — can’t. Which is why those Olympian forces will ultimately spell the end not only of Greece’s membership in the euro, but also of European monetary union more generally.” (Reuters)

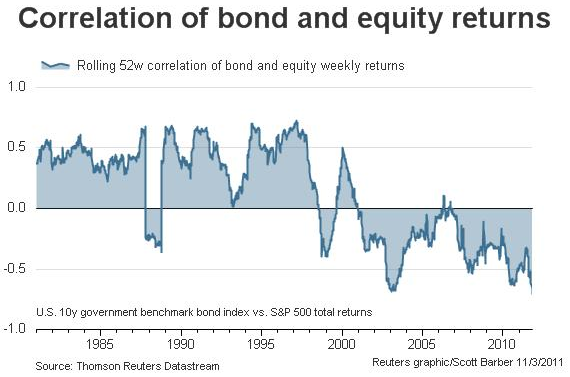

Chart of the day

The lost decade and structural break in stock-bond correlations. (Reuters via @scottybarber)

Markets

When risk and return don’t match up. (SurlyTrader)

The US stock market has become more volatile than the Chinese market. (Bespoke)

Does the $VIX demonstrate seasonality? (CXO Advisory Group)

Insider selling bounces back. (CBS Moneywatch)

Earnings and revenue beat rates. (Bespoke)

Strategy

Interloper, “The market then, is not rigged against your investment success– you’re brain is.” (The Interloper)

Gold miners are no longer a leveraged play on gold. (The Reformed Broker)

On the dangers of trading in the pre-market (or post-market). (Kid Dynamite)

REITs beat private real estate funds. (Institutional Investor)

On the challenge of variable trade sizing. (Tyler’s Trading)

Companies

Eight things Apple ($AAPL) should do with its cash. (I Heart Wall Street)

Should Apple pay a dividend? (The Tech Trade)

Netflix ($NFLX) vs. AOL ($AOL): a decade in one chart. (SplatF)

Things are not getting better for the global reinsurance industry. (The Source)

Groupon

Trying to put a price on Groupon. (Aswath Damodaran also SAI)

Is Groupon going to price above the range? (Term Sheet, Felix Salmon)

Finance

Jeffries Group ($JEF) responds to rumors. (FT Alphaville)

The final 72 hours of MF Global. (Dealbook)

Banks are “raining assets” in an effort to reduce risk. (WSJ)

Too many startups or too few venture dollars? (Information Arbitrage)

Funds

Measuring the performance of the Ivy Portfolio. (dshort)

Why investors are so willing to pay high mutual fund fees – they never see them. (Wealthfront)

Don’t always trust mutual fund data. (Total Return)

How can investment advisors live with themselves? (Economic Intersection)

Europe

The ECB cuts rates. (MarketBeat, FT, Crackerjack Finance)

The Greek endgame is near. (MarketBeat)

The Italian engame is near. (FT Alphaville, The Source)

Will the ECB step up its purchases of troubled sovereign debt? (Gavyn Davies)

Does Europe really want a two-tier government bond market? (Buttonwood)

Europe needs a common banking system before a more integrated union. (Project Syndicate)

Economy

Jobless claims edge lower. (Capital Spectator)

The ISM Non-Manufacturing Index shows expansion. (Calculated Risk)

The “war on savers” continues apace. (Real Time Economics)

Productivity jumped in Q3. (Bloomberg)

The Fed keeps cutting its estimates for growth. (The Atlantic)

Should we fear the drop in gasoline consumption? (Bonddad Blog)

Dividend swaps point towards continued sluggish economic growth, not recession. (Bloomberg)

A longer term look at the ADP employment figures. (EconomPic Data also Money & Co.)

High rental yields: hope for the housing market. (EconLog)

What we need to fix the economy. (Money Game)

Food

Why a trip to the grocery store is costing more these days. (Points and Figures)

On the dangers of US biofuel policies. (Big Picture Agriculture)

Earlier on Abnormal Returns

Nothing in excess, including momentum strategies. (Abnormal Returns)

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Mixed media

Only YOU can control your checkbook. (Bucks Blog)

The inevitable Steve Jobs backlash is here. (NYTimes)

Time to narrow the goal posts. (Crossing Wall Street)

Why we need arts majors. (Economist)

In praise of cheap wine. (Slate)

Abnormal Returns is a founding member of the StockTwits Blog Network.