A few weeks ago we wrote about the so-called “Halloween indicator” or the idea that you should sell stocks in May and buy them back around Halloween. Recent research ties together this phenomenon with seasonal affective disorder or SAD. Another approach that involves simply rotating from defensive to cyclical sectors based on seasonality has been around for awhile as well. In an article at Globe Investor Nicolas Johnson looks at a “Rotate in May” strategy. He notes that the historical evidence for this phenomenon is strong:

He [Stovall] found that holding the economically insensitive Consumer Staples and Health Care groups for the summer and rotating into the more volatile Materials and Industrials sectors for the winter would have led to compounded gains of 13.1 per cent on average each year, compared with 6.7 per cent for the S&P 500. The sector-rotation strategy beat the index 82 per cent of the time, he said.

Stovall’s data only goes back to 1990. However there is additional research that goes back to the 1920s that demonstrates this phenomenon. Johnson found a couple of skeptics who believed the results of this strategy were simply a result of data-mining and therefore should note be expected to outperform going forward.

Successful stock market strategies tend to be based upon robust logic, not just apparent patterns in data, said Stephen Foerster, professor of finance at the University of Western Ontario’s Richard Ivey School of Business. “There’s always the question of whether this is just happenstance, or if there is some reason why it might happen in the future,”

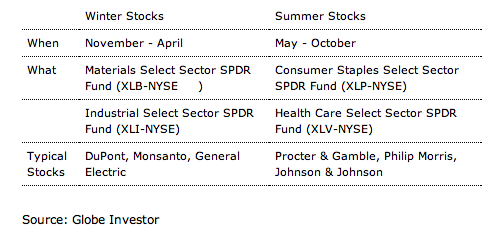

One could argue that the research into SAD and mood help explain why the seasonality in the equity markets is more than just data mining. That being said Johnson notes that implementing a seasonality strategy involves transaction costs, taxes and the risk of underperformance. For those still interested he includes a handy chart laying out the strategy:

As active strategies go this one is pretty easy to implement: a couple of trades a year. In a certain respect it is a perfect strategy for those dipping their toes into active management. There are a couple of risks to this strategy. The first is that the stock market itself declines. Then again that is always a risk to any equity-centric strategy. The second risk is that a “rotate in May” strategy underperforms the broader market. As always it is up to investors to decide whether it is a strategy based in reality or simply data mining.

Items mentioned above:

[earlier] SAD and the Halloween indicator. (Abnormal Returns)

[way earlier] Rotate in May? (Abnormal Returns)

The Halloween effect in US sectors. (SSRN)

Is a “rotate in May” strategy just a result of data mining? (Globe and Mail)