Quote of the day

John Kay, “Models are often useful in illuminating complex problems and quantification is an essential part of decision making. But good models are simplifications, not black boxes whose workings are incomprehensible even to their operators” (John Kay)

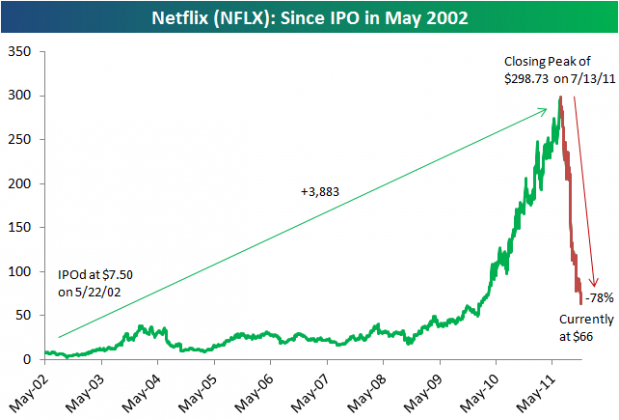

Chart of the day

The long rise and quick fall in Netflix ($NFLX). (Bespoke)

Markets

A triple whammy of good news. (Pragmatic Capitalism contra Free exchange)

What the $VIX is doing today in light of a huge rally. (VIX and More)

Gold sentiment is supportive of a rally. (Mark Hulbert, Global Macro Monitor)

Some tax-loss harvesting ideas using ETFs. (allETF)

Strategy

On the importance of being properly bankrolled as a trader. (chessNwine)

A TAA model for December. (MarketSci Blog)

Fees vs. commissions: the Darwinian changes afoot in the advisory business. (Financial Adviser)

Companies

The question isn’t why AMR filed bankruptcy, the question is why did it wait so long? (WSJ, Planet Money)

Should Berkshire Hathaway ($BRKB) be buying back stock or the Omaha World-Herald? (WSJ)

To create a great company founders need a lot of help along the way. (Information Arbitrage)

What is the marginal product of a CEO? (Marginal Revolution)

Finance

Sentiment on Wall Street is growing increasingly disenchanted with Wall Street. (Dealbook)

Do you want to buy a piece of the Empire State Building? Now’s your chance. (Dealbook)

Brokers are going after frenetic options traders. (InvestmentNews)

Funds

John Paulson’s mea culpa to investors. (NetNet, WSJ)

Goldman Sachs ($GS) is making a big push into hedge fund seeding. (WSJ)

Currency funds are having a tough time. (WSJ)

ETFs

Investors are looking hard for money market alternatives. (Focus on Funds)

Risk on/Risk off ETNs. Seriously? (IndexUniverse)

Global

Does the world need more central bank action? (The Atlantic, Term Sheet)

The stunning move in the German yield curve. (Money Game)

The case for another lost (and rocky) decade. (FT Alphaville)

China begins easing once again. (NYTimes, WSJ, Crackerjack Finance)

The “new normal” for Indian GDP growth. (beyondbrics, Real Time Economics)

Economy

What are Fed swap lines and what are they good for? (Real Time Economics also Wonkblog, NetNet, The Source)

A surprising ADP private jobs figure bodes well for non farm payrolls. (Capital Spectator, Money Game)

The divergence between retail sales and consumer sentiment. (Bonddad Blog)

More indicators that the economic expansion is still on track. (Calculated Risk)

The US is set to become a net fuel exporter for the first time in 62 years. (WSJ)

Earlier on Abnormal Returns

People forget Apple is now a megacap. (Abnormal Returns)

What you missed in our Wednesday morning linkfest. (Abnormal Returns)

Mixed media

Drawing lessons from the truly talented rarely makes sense for the rest of us. (Interloper)

In praise of Roger L. Martin’s Fixing the Game: Bubbles, Crashes, and What Capitalism Can Learn from the NFL![]() . (Forbes)

. (Forbes)

The 50 best albums of 2011. (Paste Magazine)

Abnormal Returns is a founding member of the StockTwits Blog Network.