Quote of the day

Wesley Gray, “One of the beauties of quantitative investing is the complete removal of human emotion from the investment process…If you like to meddle in the results, quant isn’t for you.” (Turnkey Analyst)

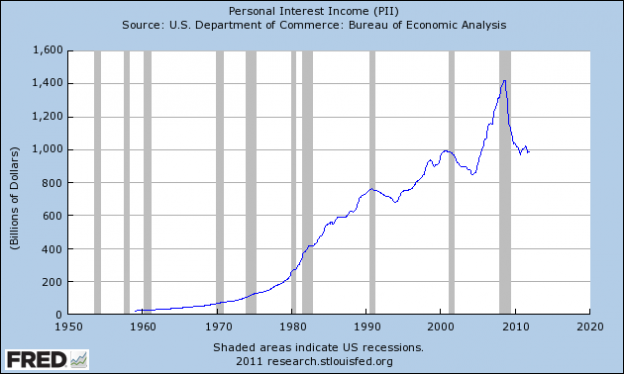

Chart of the day

The war on savers visualized. (Credit Writedowns)

Markets

The average investor is focused on capital preservation. (Big Picture, Barron’s)

A visual look at investor sentiment. (World Beta)

The S&P 500 is set for a golden cross. (MarketBeat)

The credit markets are still quite accommodating to borrowers. (Distressed Debt Investing)

Look out if we experience a “return to normalcy.” (Market Anthropology)

The fundamentals surrounding the high yield bond market. (Sober Look)

Strategy

What are the downsides of using a 10-month simple moving average system. (The Technical Take)

Low bond yields make building a portfolio harder. (NYTimes)

The pain for money market investors is going to continue. (Marketwatch)

A certain kind of covered call strategy greatly enhanced returns over the past sixteen years. (Barron’s)

Companies

Michael Santoli, “(W)hen cash piles up high enough, the market simply will not pay up for it. This isn’t only because cash yields next to nothing today, but because at a certain point nothing productive or value-generating can be done with it.” (Barron’s)

Companies once again have started lowering their earnings guidance. (Bespoke)

The shipping industry is in a deep slump. (Can Turtles Fly? also Minyanville)

St. Joe ($JOE) is bowing to the reality of the Florida real estate market. (WSJ)

Facebook IPO

Facebook is preparing an IPO. Who wins and at what price? (WSJ, ibid, ibid)

Would a Facebook IPO lead to another venture capital boom? (Deal Journal)

Don’t expect the bankers to make out on a Facebook IPO. (Dealbreaker)

Finance

Pension plans still have way too optimistic expectations for equity market returns. (Jason Zweig)

Paul Amery, “There are two simple reasons why ETFs continue to gain market share from traditional funds: they are cheaper and more flexible.” (IndexUniverse)

Global

Greece and its private creditors are on the verge of a deal. (WSJ)

Emerging market equities trade at a discount to the developed markets. Should they? (Scott Barber)

Now that things have calmed down is it time to bet on the breakup of the Euro? (Reuters)

Economy

More looks at the economy in light of Q4 GDP. (Econbrowser, Modeled Behavior, Bonddad Blog)

Look at what the markets are saying about zero interest rates through 2014. (Sober Look also FT Alphaville)

Just how weak is the recovery? (Bespoke)

In praise of the Obama recovery. (Money Game)

How a more German approach to manufacturing could create American jobs. (Fortune)

Earlier on Abnormal Returns

Ten word investment philosophies. (Abnormal Returns)

Top clicks this week on Abnormal Returns. (Abnormal Returns)

What you missed in our long form Saturday linkfest. (Abnormal Returns)

Mixed media

A list of the twenty “Best Alternative Financial Blogs” including Abnormal Returns. (NetNet also Pragmatic Capitalism, The Reformed Broker)

Abnormal Returns is a founding member of the StockTwits Blog Network.