Quote of the day

David Swensen, “A fiduciary would offer low-volatility funds and encourage investors to stay the course,” he said. “But the for-profit mutual fund industry benefits by offering high-volatility funds.” (Justin Fox)

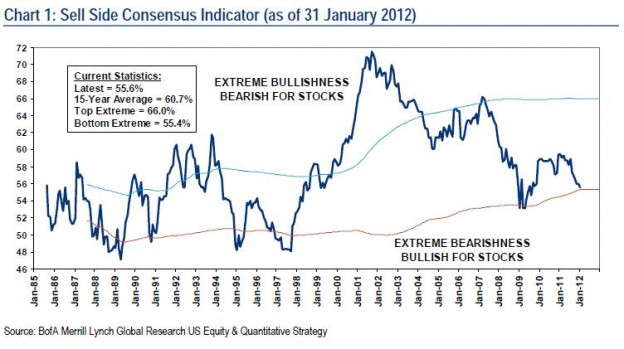

Chart of the day

A mess of interesting charts including one showing that sell-side strategists are relatively bearish. (Stone Street Advisors)

Markets

The “flight to risk” accelerates. (Stock Sage)

News flash: country ETFs are overbought. (Bespoke)

Realized volatility is “ridiculously low.” (Investing With Options)

The market surge should not be surprising given previous reactions to open monetary spigots. (Market Anthropology)

Interest rates

Why MBS rates are “so damn low.” (The Basis Point)

More backlash against the “war on savers” meme. (DTAF)

Why should we be surprised when private equity takes advantage of low interest rates. (Macroeconomic Resilience)

Strategy

Josh Brown, “What’s the big deal? Why can’t anyone be wrong anymore?” (The Reformed Broker)

Investors eat dollar-weighted returns. (Aleph Blog)

Combining trend following and option selling strategies. (Condor Options also World Beta)

Companies

The big difference between Amazon ($AMZN) and Apple ($AAPL). (TechCrunch)

Groupon ($GRPN) competitor LivingSocial lost a bucketload of money in 2011. (VentureBeat)

Nat Torkington, “Tech Giant IPOs are like Royal Weddings: the people act nice but you know it’s a seething roiling pit of hate, greed, money, and desperation that goes on a bit too long so by the end you just want to put an angry chili-covered porcupine in everyone’s anus and set them all on fire. But perhaps I’m jaded.” (O’Reilly radar via Daring Fireball)

How much is Facebook worth? (Henry Blodet, Eric Jackson)

Facebook succeeded in part by being patient and ignoring the haters. (Bijan Sabet)

Don’t forget that Zuck controls Facebook, public shareholders or not. (Deal Journal)

Facebook has an infrastructure challenge. (GigaOM)

Finance

How venture capital differs from private equity. (Baseline Scenario)

On the rise of the venture capital megafund. (Pando Daily)

The bond market’s middlemen have disappeared. (research puzzle pix)

The CME Group ($CME) is creating a fund to protect farmers and ranchers. (Dealbook, WSJ)

Why the DB-NYSE deal failed. (Economist)

ETFs

Is the cheapest ETF always the best? (IndexUniverse)

Bond ETFs for every occasion. (ETFdb)

A slew of commodity equity ETFs launch. (IndexUniverse)

Global

Spain is still the key to the survival of the Euro. (Crackerjack Finance)

You can’t have jobs without cities: China edition. (Felix Salmon)

Economy

Calls for a double-dip look premature, at best. (Bonddad Blog)

A January employment report preview. (A Dash of Insight)

Rail traffic continues to trend above 2011 levels. (ValuePlays)

Weekly initial unemployment claims slowly trend lower. (Calculated Risk, Capital Spectator)

More reactions to Charles Murray’s new book Coming Apart: The State of White America, 1960-2010![]() . (EconLog, Marginal Revolution, Falkenblog)

. (EconLog, Marginal Revolution, Falkenblog)

Earlier on Abnormal Returns

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Mixed media

Check out Vuru for DIY fundamental analysis. (Dynamic Hedge)

‘Huffington Post’ employee sucked into aggregation turbine. (The Onion)

Abnormal Returns is a founding member of the StockTwits Blog Network.