Quote of the day

Eduardo Porter, “Europe would be in much better shape if the euro didn’t exist and each member country had its own currency.” (NYTimes)

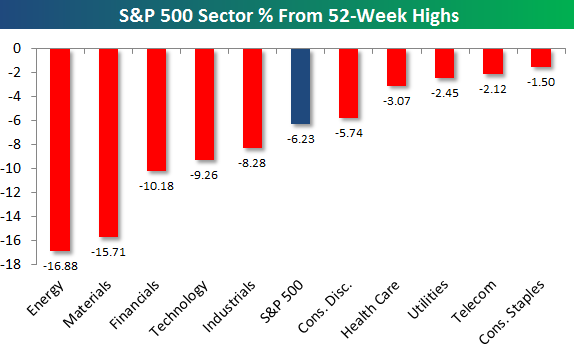

Chart of the day

Defensive sectors are outperforming. (Bespoke also StockCharts Blog)

Bonds

The bond bull market lives. (Crossing Wall Street)

Few investors have been hurt yet by embracing the safe haven trade. (FT)

High yield bond spreads are hanging in there. (BondSquawk)

Europeans love high yield bonds as well. (Sober Look)

Markets

The depressing nature of first day IPO pops. (Dan Ariely)

Higher correlations are creeping into the options market. (Adam Warner)

The Euro crisis has put a number of stocks on sale. (A Dash of Insight)

US farmland prices continue to surge. (WSJ, FT)

Strategy

Three approaches to hedging with options. (VIX and More)

Seven reasons to sit in cash. (Joe Fahmy)

New traders today have advantages that we never did. (Brian Lund)

Why tax-efficient investing matters. (Forbes)

Why you should treat trading like a business. (Mindful Money)

Companies

Ten steps Yahoo! ($YHOO) needs to take to succeed. (Eric Jackson)

Leucadia National ($LUK) is now very much an inflation play. (The Brooklyn Investor)

Funds

Vanguard is just crushing the competition. (InvestmentNews)

Ric Edelman on the end of mutual funds. (IndexUniverse)

Do hedge funds outperform stocks and bonds? (SSRN via @jasonzweigwsj)

Global

The renminbi need not always appreciate. (FT Alphaville)

Brazil goes negative on the year. (Global Macro Monitor)

Greece

Greece simply can’t pay its bills in Euros. (Tim Duy also Free exchange)

How a Greek exit from the Euro might happen. (Fortune)

Europe is using the wrong measure of inflation. (The Atlantic)

Canada

What Canadian pension funds get right. (peHUB)

Is Canadian manufacturing suffering from “Dutch disease”? (Globe and Mail)

Economy

Industrial production rebounded in April. (Capital Spectator also Pragmatic Capitalism)

Where do “free services” like Dropbox show up in government economic statistics? (Mandel on Innovation)

What contribution might housing make to GDP? (Modeled Behavior)

The prospect for lower gasoline prices. (Econbrowser)

Why bubbles are great for the super-rich. (The Atlantic)

Earlier on Abnormal Returns

A linkfest for those people looking for more Facebook links. (Abnormal Returns)

What we are reading: Abnormal Returns edition. (Market Folly)

You are not as right as you think you are. (Abnormal Returns)

What you missed in our Wednesday morning linkfest. (Abnormal Returns)

Ask a distinguished panel of bloggers a question: win a copy of the Abnormal Returns book. What’s not to like? (Abnormal Returns)

Mixed media

Looking forward to reading Jack Schwager’s Hedge Fund Market Wizards. (World Beta)

Why Apple is moving toward a bigger screen for the new iPhone. (GigaOM)

Pliny the Younger is supposedly the best beer in the world. (Slate)

Abnormal Returns is a founding member of the StockTwits Blog Network.