Quote of the day

Craig Birk, “Mutual funds are a lot like the VCR. They made our lives better at one time, but now there are clearly better options. Pretty soon only your most eccentric friends will own one.” (Financial Adviser)

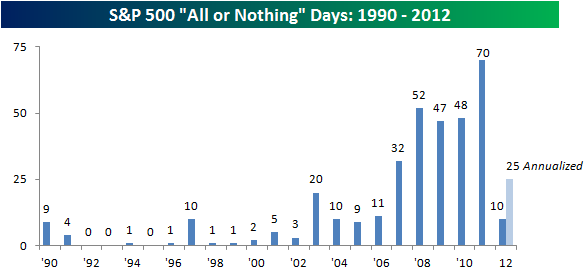

Chart of the day

All-or-nothing days are on the rise. (Bespoke)

Markets

If everyone is so nervous why isn’t the $VIX higher? (Humble Student of the Markets)

A look at global Shiller CAPEs. Guess what countries stand out? (World Beta)

Vanguard tells high yield bond investors to chill. (Focus on Funds, The Reformed Broker)

Why gold miners were due for a bounce. (Market Anthropology)

The low volatility anomaly is not all that new. (Falkenblog earlier Abnormal Returns, ibid)

Strategy

Peter L. Brandt, “Many novice pedestrian traders focus on the next position. Consistently success traders focus on the process and care little about the outcome of the next trade. The distinction is enormous.” (Peter L. Brandt)

Happy people make terrible traders: on mood, overconfidence and overtrading. (The Psy-Fi Blog)

What is “risk intelligence” and how can it be measured? (New Scientist/Slate)

A list of some trading system backtesters and updates. (World Beta)

Hedge funds

Favorite lines from the Ira Sohn Conference. (Distressed Debt Investing)

Big hedge funds heart big caps. (Sober Look)

Companies

How much longer can Procter & Gamble ($PG) afford to pay out its juicy dividend? (YCharts Blog)

Hewlett-Packard ($HPQ) does not want you to pay attention to GAAP earnings. (Jeff Matthews)

Blackstone Group ($BX) continues to see asset inflows. (SumZero)

Startups

Are business accelerators the future of startups? (WSJ)

The beer business does not have the profit margins of technology. (The Atlantic)

SpaceX continues to fly right. (LATimes)

Trading

Two different ways to deal with high frequency traders. (Aleph Blog, WSJ)

Can we reduce HFT by actually regulating it less? (Dealbreaker)

Should stocks trade in $.0001 increments? (Marginal Revolution)

Finance

Bank profits are at five year highs. (Term Sheet)

How to end the TBTF bank problem. (Big Picture)

Let the “emerging growth company” IPOs commence. (footnoted)

What’s the difference between portfolio analytics and risk management? (Institutional Investor)

ETFs

Copper consumers really don’t want a physical-backed copper ETF to launch. (Bloomberg, FT)

ETF investors should not take their eyes off the ball. (Ari Weinberg)

Global

Flash PMI fun: Chinese manufacturing still contracting. (FT Alphaville, beyondbrics)

Rising odds of a Euro breakup have lead to a lower Euro. (Sober Look)

What Japan needs is big dose of private equity. (Noahpinion)

What if China only grows 3% a year for the next decade? (research puzzle pix)

Electricity as an economic indicator. (beyondbrics)

Economy

Weekly initial unemployment claims were pretty much flat. (Calculated Risk, Bespoke)

Rail traffic is hanging in there. (Pragmatic Capitalism)

Cheaper natural gas is making inroads into trucking and reducing CO2 emissions. (WSJ, FT)

Inflation pressures continue to ease. (Carpe Diem)

Earlier on Abnormal Returns

The seeds of a new secular bull market are being sown. (Abnormal Returns)

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Mixed media

Some Twitter advice for Goldman Sachs ($GS). (The Reformed Broker)

Henry Blodget and Business Insider own the Facebook story. (Slate)

How did an Australian CPA get an hour-long interview with Neil Armstrong? (The Guardian via @moneyscience)

Abnormal Returns is a founding member of the StockTwits Blog Network.