Yesterday we answered a question from our “finance blogger wisdom” series on where the best opportunities are over the next ten years. We talked about how it is that equities are likely to outperform Treasuries over the next ten years. We wrote:

The first is single family homes in stable areas as rental properties. With 30-year mortgage rates at sub-4% levels it now seems like it pays to be a landlord these days. All you need is home prices to stabilize for awhile to make real money. The second is a total return swap of US Treasuries for US equities. Now that this is a positive carry trade it seems like things are now in equity investors’ favor.

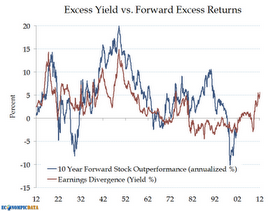

Jake at EconomPic Data has a nice short post up today that looks at this very issue. He looks the relationship between “excess yield” of the difference between the earnings yield on equities vs. the yield on Treasuries. When that spread is historically high you tend to see greater than average equity outperformance. You can see this in the graph below:

Jake concludes his post with an appropriate caveat:

While I refuse to state that returns will be anywhere near this 9.5%, by almost all measures stocks appear cheap on a relative basis to Treasury bonds. Unless earnings collapse back to a “normal” percent of the overall economic pie abruptly (definitely possible, but in my view not likely) or the economic pie contracts abruptly, stocks are going to outperform bonds over the next ten years.

Now the question becomes for investors how they should play this admittedly long term bias towards equities. For that stay tuned.