Quote of the day

MicroFundy, “You can’t compare the Net Income, EPS, and hence PE Ratios of companies in different sectors.” (MicroFundy)

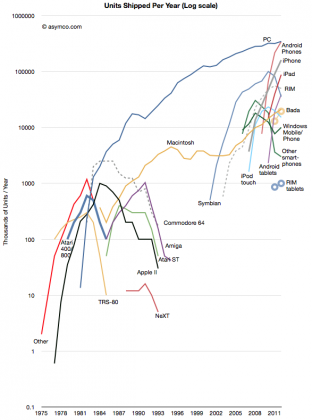

Chart of the day

The evolution of the computing value chain. (Asymco)

Markets

What does Warren Buffett’s favorite indicator say at the moment? (Pragmatic Capitalism)

An indicator pointing towards greater risk appetites for equities. (Big Picture)

Do moving averages still work? (Mark Hulbert)

Equities are rallying without oil. (Bespoke)

What if financials really start upping their dividends? (Crossing Wall Street)

Treasury bonds

Is there an “extra liquidity premium” in Treasury bonds? (Modeled Behavior)

Who is buying all those Treasury bonds? (Sober Look)

Strategy

Five things that freak a trader out. (Brian Lund)

Deliberate practice: the value stock version using hidden tickers. (Distressed Debt Investing)

Are you using the right default cost basis method? (Nerd’s Eye View)

Target date funds can differ widely in their performance. (research puzzle pix)

Companies

FedEx ($FDX) on the slowing global economy. (Pragmatic Capitalism)

Dividends are fine for private equity holders, just not public shareholders. (Term Sheet)

Electronics retailing is in upheaval. (NYTimes)

The case for the cash machine that is CBS ($CBS). (SumZero)

Finance

Why Wells Fargo ($WFC) continues to outperform its peers. (The Brooklyn Investor)

Many big hedge funds lack clear succession plans. (Institutional Investor)

Venture capital

The IPO window is not completely closed: ServiceNow plans to price this month. (WSJ)

“High valuation, late-stage” funding rounds are now under much more scrutiny post-Facebook. (WSJ)

Friends should careful when investing in venture deals together. (Real Time Economics)

Most entrepreneurs have only one really good idea in their careers. (Eric Jackson)

ETFs

The opportunity in senior bank loan ETFs. (FT Alphaville)

Five ETF swaps worth considering. (IndexUniverse)

A closer look at Guggenheim BulletShares ETFs. (allETF)

Global

Monday proved that nothing changed in Europe. (Tim Duy)

Why the situation in Greece is hopeless. (Dealbook)

Can the Russian economy make a transition away from oil & gas? (FT Alphaville)

Economy

Why we should see some additional kick to the economy from housing. (Modeled Behavior, Capital Spectator)

Do we pay too much information to the monthly jobless numbers? (NYTimes)

Earlier on Abnormal Returns

“Excess yield” or why investors should have an equity bias over the next decade. (Abnormal Returns)

What you missed in our Tuesday morning linkfest. (Abnormal Returns)

Is the investment management industry truly at-risk of online, algorithmic disruption? (Abnormal Returns)

Turnabout is fair play: our answers to the “finance blogger wisdom” questions. (Abnormal Returns)

Mixed media

An interview with Scott Patterson author of Dark Pools: High-Speed Traders, A.I. Bandits, and the Threat to the Global Financial System. (The Ticker)

Is the Surface the iPad competitor every tech writer wants? (Slate, Pogue)

Abnormal Returns is a founding member of the StockTwits Blog Network.