Quote of the day

Howard Lindzon, “Strategies are not something you can pick out of thin air and just make your own. It takes time.” (Howard Lindzon)

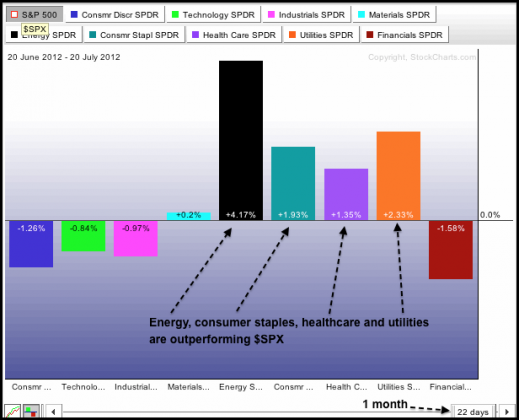

Chart of the day

Defensive sectors continue to lead this market. (StockCharts Blog)

Markets

On the importance of letting your returns speak for themselves. (The Reformed Broker)

The stock and bond markets he stock and bond markets have diverged. (@jackdamn)

As have the defensive and offensive sectors of the market. (Barron’s)

Where did all the bulls go? (Horan Capital)

Bonds

Corporate bond liquidity is drying up. (Sober Look)

Ritholtz on the basics of owning bonds. (WashingtonPost)

While the high yield bond market is a bit of freight train. (Sober Look)

A nice overview of where Treasury yields have been. (dshort)

Trading

Why we are driven to trade: our brain is constantly looking for patterns, even illusory ones. (Jason Zweig)

Why do you trade? No seriously, why? (The Minimalist Trader)

You can’t trade well if you don’t have everything else together. (Joe Fahmy)

Companies

Fresh juice is the new coffee. (Barron’s)

An alternative explanation for high corporate cash levels. (Macro Rants)

Finance

Nasdaq’s mea culpa for the Facebook IPO is becoming more costly. (Dealbook, WSJ)

Why Fender pulled its IPO. (Fortune)

Backtested ETF performance seems to fade away once the fund starts trading. (Barron’s)

Global

China has a bad debt problem. (Vitaliy Katsenelson)

Higher grain prices can have wide-ranging effects. (Sober Look, WSJ)

The fracking revolution is going global. (Wonkblog)

Just how much money is held overseas in various tax havens? (The Guardian)

Economy

Still no signs of inflation. (Carpe Diem)

We aren’t going to go over the ‘fiscal cliff‘ but the process is still going to be painful. (Econbrowser)

Earlier on Abnormal Returns

What you missed in our Saturday long form linkfest. (Abnormal Returns)

What every one was reading on Abnormal Returns this week. (Abnormal Returns)

Having read it, we can recommend Scott Patteron’s Dark Pools: High-Speed Traders, A.I. Bandits, and the Threat to the Global Financial System. (Abnormal Returns)

Mixed media

Young people are losing interest in driving. (The Atlantic)

Your favorite app got bought out. Get over it. (Matt Gemmell via @techmeme)

If you’re caught in the rain without an umbrella, is it better to run or walk in order to stay as dry as possible? (Wonkblog)

Abnormal Returns is a founding member of the StockTwits Blog Network.