Quote of the day

Josh Brown, “If you’re making allocation shifts based on which holiday to buy or sell, you’re probably not a professional.” (@reformedbroker)

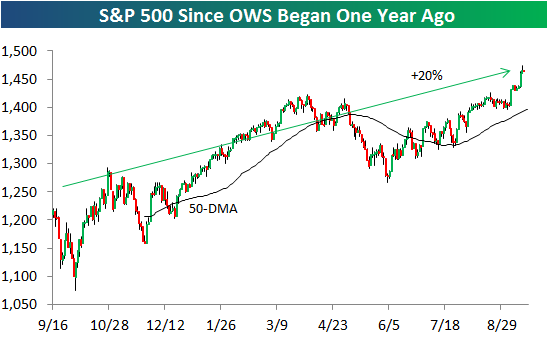

Chart of the day

The S&P 500 is up 20% since the Occupy Wall Street movement began. (Bespoke)

Markets

Q3 earnings are expected to fall. (NYTimes)

Pundits weighing in on the #1 threat to the market. (Money Game)

Commodities

Commodity producers have dramatically overestimated Chinese commodity demand. (Michael Pettis)

Is the commodity trade all driven by QE? (Market Anthropology)

MLPs

Look out: pension funds are piling into MLPs. (Pension & Investments)

Not all MLPs are created equal: on the rush into non-traditional MLPs. (WSJ)

Strategy

Most clients don’t understand back tested strategy returns. (Rick Ferri)

Another review of Eric Falkenstein’s The Missing Risk Premium: Why Low Volatility Investing Works. (Crossing Wall Street)

Companies

The value of Facebook ($FB) is in the embedded options, including search. (Chris Dixon)

The evolution of Mark Zuckerberg as CEO. (CNet)

The iPhone 5 launch was huge. (The Verge)

Payment processor Square just raised big money at a high valuation. (AllThingsD, Fortune)

Finance

The SEC is getting serious about the advantages exchanges provide to high-frequency traders. (WSJ, FT Alphaville)

How to get the US Treasury out of GM ($GM) shares. (Dealbreaker, WSJ)

Hedge funds are becoming “trusted advisers” to their clients. (Pensions & Investments)

A Q&A with Jason Kelly author of The New Tycoons: Inside the Trillion Dollar Private Equity Industry That Owns Everything. (Dealbook)

ETFs

Fidelity is beefing up its ETF efforts. (ETF Trends)

How bond ETFs have become a parallel to the dealer community. (FT Alphaville)

Global

Investors are shunning South African miners. (FT)

Can Wal-Mart ($WMT) save the Indian economy? (Slate, Time)

High wages in Norway are driving a push towards automation. (FT Alphaville)

Economy

How much will lower mortgage rates help the economy? (Sober Look)

How did high debt counties perform job-wise? (EconLog)

Earlier on Abnormal Returns

What you missed in our Monday morning linkfest. (Abnormal Returns)

Mixed media

The Winkelvoss brothers have investd in SumZero. (WSJ)

If the bride has doubts, don’t get married. (Scientific American)

The power of saying ‘I don’t know.’ (FT)

Abnormal Returns is a founding member of the StockTwits Blog Network.