If you haven’t done it already think about signing up for our daily e-mail, thousands of other Abnormal Returns readers already have.

Quote of the day

James Picerno, “..it’s no great feat to earn average returns. The main question is how much you pay for mediocrity. This is no trivial issue. ” (Capital Spectator)

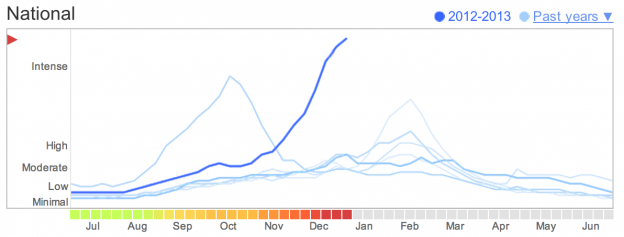

Chart of the day

The US is facing a nasty flu season. (Google Flu Trends via kottke)

Markets

Transports are nearing all-time highs. (Bespoke)

The case against high yield bonds. (Morningstar also Marketwatch)

Don’t bet no a huge reallocation from bonds into equities. (Buttonwood)

Herbalife ($HLF) It’s now Bill Ackman vs. Dan Loeb. (Dealbook, MarketBeat)

Strategy

Portfolio rebalancing applies to asset classes, not individual stocks. (Big Picture, ibid)

What the last five years have taught market participants. (Businessweek)

Don’t put too much stock in alternative asset classes. (Random Roger)

A new paper on fund flows shows investors don’t care about downside alpha. (SSRN via @quantivity)

RIP, Bob Haugen. (Falkenblog, Markewatch)

Companies

Rumors abound that Apple ($AAPL) is building a new, cheaper iPhone. (Digits, Daring Fireball, SAI)

Can Apple resist the ‘phablet’ craze? (Quartz)

Amazon ($AMZN) officially “won the Internet.” (Phil Pearlman)

Finance

A profile of Simple. (NYTimes)

The big banks are getting off easy. (Wonkblog)

Blackstone ($BX) is still buying homes hand over fist. (Bloomberg)

A look at a recent paper on how broker-dealer leverage affects asset pricing. (Econbrowser)

Are we making too big a deal of Goldman Sachs’ ($GS) proprietary trading? (FT Alphaville, Dealbreaker)

Funds

The self-indexing trend picks up a couple of big names. (IndexUniverse)

Goldman will starting reporting daily NAVs for their money market mutual funds. (WSJ)

The ETF Deathwatch for January 2013. (Invest With an Edge)

Global

Why Euro area growth is set to “suck for awhile.” (FT Alphaville)

What about Germany’s economy? (Sober Look, Tim Duy)

Economy

US oil imports fall to a 25-year low. (FT)

The case for a US manufacturing renaissance is strong. (FT)

There is nothing magical about small business. (Modeled Behavior)

Housing inventories continue to drop. (Bonddad Blog)

In case you haven’t gotten enough trillion dollar coin chatter. (Free exchange, FT Alphaville, Rortybomb)

B-school

Marginal MBA programs are charging way too much. (Economist)

Is entrepreneurship compatible with a liberal arts education? (Bloomberg)

Mixed media

The cable monopoly on set top boxes is cracking. (SplatF)

Update to Windows 8 at your own risk. (WSJ)

Diet soda will mess you up. (Bloomberg)

The end of an era. (The Real Fly)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.