Quote of the day

DH, “The market has gone from walking on pins and needles to a bit of a swagger.” (Dynamic Hedge)

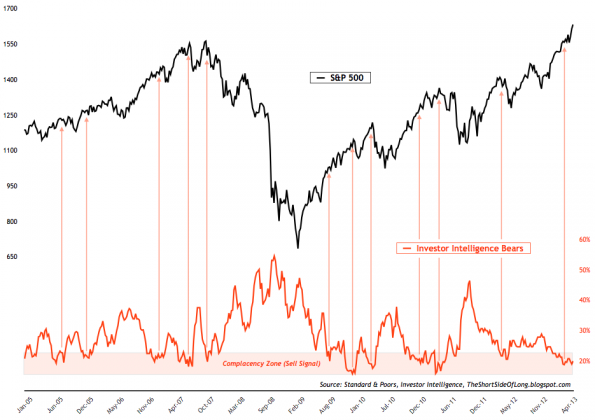

Chart of the day

Bearish investment advisers are on the endangered species list. (The Short Side of Long)

Markets

Every Wall Street strategist has been wrong about this rally. (Money Game)

Oh great, Nouriel Roubini likes the stock market. (Fortune)

Americans are giving up on CDs. (Sober Look)

Opportunities remain for investors willing to look beyond recent winners. (A Dash of Insight)

A look at sector rotation into the transports. (See It Market)

QE will not end in a day. (The Reformed Broker)

Strategy

How the (really) rich invest. (Jason Zweig)

Don’t trade: the machines have you beat. (Mark Hulbert)

On the dangers of univariate analysis: the case of corporate profit margins. (The Brooklyn Investor)

Companies

Bloom Energy has raised some $1.1 billion so far. (Quartz)

Thes lesson for founders from the Dell ($DELL) saga. (Pando Daily)

Company managements are increasingly finding themselves in the middle of proxy battles. (WSJ)

Hedge funds

Why we shouldn’t be surprised hedge funds have poor returns. (Noahpinion)

Why aren’t investors fleeing hedge funds? (New York)

Hedge fund advertisements are coming soon to a screen near you. (WSJ)

Finance

It is finally time for actively managed ETFs? (Barron’s)

A look at this week’s ‘Friday night dump‘ of SEC filings. (Quartz)

Moving up is becoming tough for young investment bankers. (Quartz)

Economy

How the Fed may exit from its extraordinary monetary measures. (WSJ)

Should the Fed care about asset bubbles? (Rational Irrationality)

How technology spreads. (Economix)

Student loans are putting a cap on spending. (NYTimes)

A look back at the economic week that was. (Bonddad Blog)

The economic schedule for the coming week. (Calculated Risk)

Earlier on Abnormal Returns

What you might have missed in our Saturday long form linkfest. (Abnormal Returns)

Top clicks this week on Abnormal Returns. (Abnormal Returns)

Mixed media

The Bloomberg data breach story is only going to get bigger. (NYTimes, CNBC, Reuters, Buzzfeed, Pando Daily)

Why e-mail newsletters won’t die. (Wired)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.