This is an early edition of the daily linkfest. We will catch up with you tomorrow.

Quote of the day

TED, “Investment banking is a jealous mistress. She does not suffer indifferent commitment gladly. And she has far too many suitors for her favors to dally with anyone who is not willing to give her one hundred percent.” (The Epicurean Dealmaker)

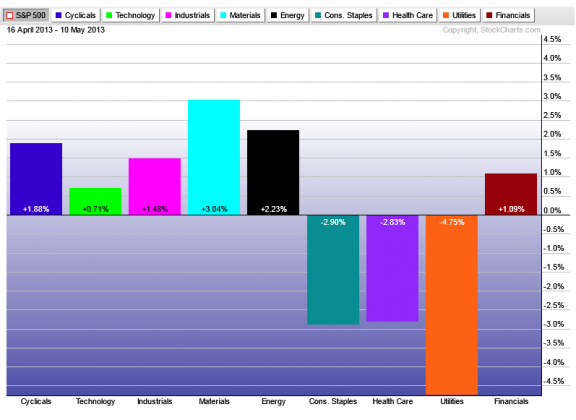

Chart of the day

Behold the sector rotation during the past month. (All Star Charts)

Markets

Fewer Americans have participated in this rally. (Money Game)

The S&P 500’s P/E is at a three-year high. (Crossing Wall Street)

Whatever happened to high yield bond defaults? (FT)

Rich Bernstein on why investors should focus on US stocks not emerging markets. (FT)

Multi-asset class funds have a hard time beating a basic benchmark. (Capital Spectator)

Strategy

Institutional investors rely heavily on past returns to make manager decisions. (SSRN)

What do you get in John Heins and Whitney Tilson’s new book The Art of Value Investing: How the World’s Best Investors Beat the Market. (Reading the Markets)

Bob Rice author of The Alternative Answer: The Nontraditional Investments That Drive the World’s Best-Performing Portfolios on liquid alternative assets. (Daily Ticker)

Companies

What industry is most at-risk to an Apple TV? (HBR)

Why does Facebook ($FB) want to buy Waze? (SAI)

Facebook Home looks like a flop. (TechCrunch via SAI)

Not all buybacks are created equal. (YCharts Blog)

How ABC plans to combat Aereo: live streaming. (GigaOM)

Finance

Hedge fund titans are reading from the wrong inflation playbook. (Behavioral Macro)

Mortgage hedge funds are all the rage. (Term Sheet)

Bloomberg LP is a data sucking machine. (Quartz also WSJ)

American banks are once again the world leaders. (Economist)

IPOs are once again the rage. (WSJ)

Global

Where the heck is inflation? (Money Game, Bonddad Blog)

Oil-tonne miles are surprisingly on the rise. (FT)

Economy

Retail sales unexpectedly rose in April. (Calculated Risk)

How might the stock market respond to Fed tightening? (Tim Duy)

Is the Fed targeting the wrong unemployment rate? (Gavyn Davies)

Mixed media

Career advice from economists. (Planet Money)

Behold the future: in-vitro meat. (NYTimes)

It is in our nature to need and tell stories. (Scientific American)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.