Quote of the day

Jason Zweig, “Turnaround Tuesday is a reminder of Wall Street’s most enduring mental handicap: amnesia. Tuesdays haven’t always been a lucky day. Far from it.” (Total Return)

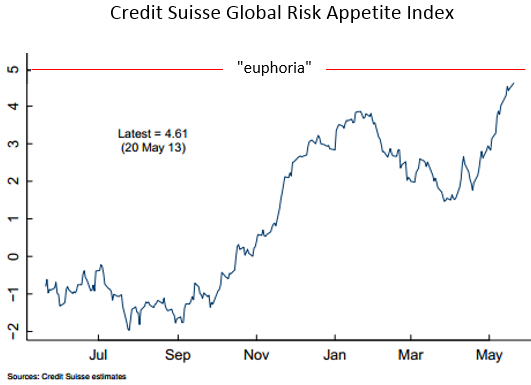

Chart of the day

The Credit Suisse Global Risk Appetite Index is nearing euphoric levels. (Sober Look)

Markets

Sentiment by this measure is “extreme.” (Andrew Thrasher)

Some market divergences. (Charts etc.)

Investors can’t get enough leveraged loans. (FT)

Why do so many investors believe in a ‘summer rally’? (Mark Hulbert)

It would be nice to see faster revenue growth from the S&P 500 companies. (Dr. Ed’s Blog)

Check out the move in silver. (SurlyTrader, The Short Side of Long)

Strategy

Stocks the “ultimate stock pickers” are buying. (Morningstar)

The Great Rotation isn’t all that true. (Quartz)

Fighting against confirmation bias is tough, but necessary. (Bucks Blog)

Tumblr

Yahoo! ($YHOO) can afford a mistake with Tumblr. (Dealbook, Pando Daily)

Tumblr is in large part a one man band. (Marco Ament)

The downside of cash: the tax implications of the Yahoo! ($YHOO) deal for Tumblr. (Dealbook)

Yahoo should have bought Pinterest instead. (GigaOM)

Companies

What Tesla ($TSLA) says about the future. (Chicago Sean)

Conditions are right for an M&A wave. (Slate also Dealbook)

Compensation for outside directors keeps rising. (WSJ)

Four companies that are ignoring shareholder votes. (Quartz)

The true spirit of the corporate tax code. (Dealbreaker)

Finance

A Fed paper on why HFT needs to be slowed down. (WSJ)

Why hedge funds want to advertise: it works. (SSRN)

VC-backed IPOs are rocking year-to-date. (peHUB)

Financial chat seems to be splintering a bit as firms look for alternatives to Bloomberg. (WSJ, Dealbook)

ETFs

Checking in on the ETF industry at $1.5 trillion in AUM. (IndexUniverse)

A nice start for Global X Top Guru Holdings Index ETF ($GURU). (Businessweek)

A closer look at the Cambria Shareholder Yield ETF ($SYLD). (Invest With an Edge)

Why financial advisors are warming to ETFs. (Wealth Management)

Survivorship bias is a growing problem with the ETF space. (WSJ)

Goldman Sachs ($GS) has a mutual fund made up with hedge funds. (Big Picture)

Global

Capital is only flowing towards emerging markets with some growth. (FT)

The Aussie dollar has broken down. (Bonddad Blog)

Economy

Putting the farmland bubble to the test. (FT)

The end of the car age. (Money Game, Quartz)

What’s the deal with falling lumber prices? (Calculated Risk)

Earlier on Abnormal Returns

The mirage that is financial literacy: a take on Helaine Olen’s Pound Foolish: The Dark Side of the Personal Finance Industry. (Amazon Money & Markets)

Mixed media

Writers should be paid. (Pando Daily)

Chris Dillow of Stumbling and Mumbling on why he blogs. (Pieria)

This just goes to show that intellectual breakthroughs can come from anywhere. (kottke also NYTimes)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.