This is an early (and incomplete) edition of the linkfest. We will catch up tomorrow. Good luck out there.

Quote of the day

Francisco Dao, “Success doesn’t come from feel-good messages and overinflated self esteem. It comes from grit, rules, and discipline.” (Pando Daily)

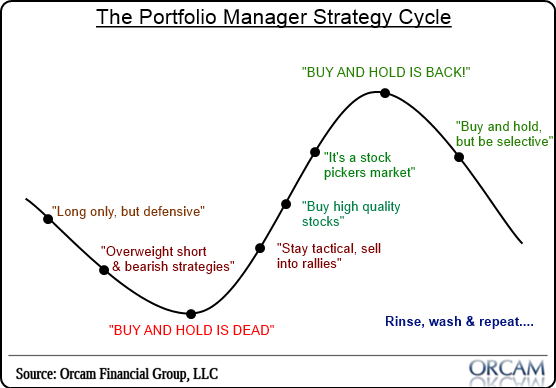

Chart of the day

The portfolio manager strategy cycle. (Pragmatic Capitalism)

Markets

Share repurchases are a huge positive for the market. (Capital Observer)

Check out the spread in asset class returns year-to-date. (Capital Spectator)

Three things not to worry about. (Mark Hulbert)

What to do about REITs? (Mebane Faber)

Investors are pouring into junk stocks. (FT)

The Mexican stock market is pulling back. (Bespoke)

Strategy

Why blowhards don’t make money. (The Reformed Broker)

Time to trim. (Aleph Blog)

In a complex world, investing should be simple. (CBS Moneywatch)

Companies

Taxes are not Apple’s ($AAPL) biggest worry. (FT)

Why Warren Buffett may very well be irreplaceable. (Dealbook contra Jeff Matthews)

Finance

Tim Cook 1: The Senate 0. (Felix Salmon also Dealbook, Bloomberg)

How much does Jamie Dimon matter? (Bethany McLean via Dealbreaker)

Funds

A showdown is coming over the management of the Firsthand Technology Value Fund ($SVVC). (MoneyBeat)

Why buy the fund when you can buy the fund manager? (InvestmentNews)

QuantShares gets acquired. (IndexUniverse)

Economy

Are we living in a time of asset bubbles? (Marginal Revolution)

On the need for clarity in unwinding quantitative easing. (Tim Duy)

Transport

Truck traffic is up solidly year-over-year. (Calculated Risk)

Gasoline prices are not going down. (Bespoke)

How rail is reshaping America’s energy system. (Open Markets)

Mixed media

Teens are switching from Facebook ($FB) to Twitter to avoid “drama.” (AP)

Embrace the business model that threatens you. (HBR)

Everybody is raving about Microsoft’s ($MSFT) new XBox One. (Pando Daily, Slate, Wired, AllThingsD, New Yorker)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.