Quote of the day

Eli Radke, “The reaction to the number is always more important than the number.” (TraderHabits)

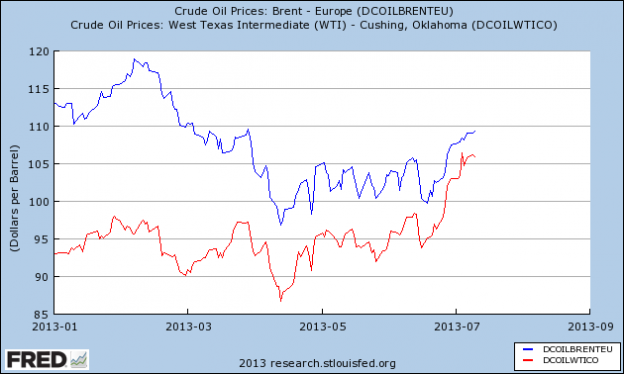

Chart of the day

Is the narrowing of the Brent-WTI spread the trade of the year? (Sober Look)

Earnings

Why does everyone freak out at quarterly earnings? (Avondale Asset)

When analyzing earnings look forward not back. (A Dash of Insight)

Why expectations matter. (Aleph Blog)

Hated markets

The long-term case for Brazil’s stock market, one of the most hated in the world. (The Reformed Broker, ibid)

The “everyone hates it” portfolio. (Infront Blog)

Is it finally time for gold miners? (Monevator)

Strategy

The fear trade has been demolished. (Pragmatic Capitalism)

Ideologically driven investors are mad because they have missed the rally. (Big Picture)

Sometimes ‘closet indexers‘ actually outperform. (Rekenthaler Report)

Why diversification is a tried-and-true approach. (Chuck Jaffe)

Books

A dozen things learned from Daniel Kahneman, author of Thinking Fast and Slow. (25iq)

A rave review of John Del Vecchio and Tom Jacobs’ book What’s Behind the Numbers? A Guide to Exposing Financial Chicanery and Avoiding Huge Losses in Your Portfolio. (Old School Value)

You can still get a free e-copy of Mebane Faber’s book Shareholder Yield: A Better Approach to Dividend Investing. (Amazon)

Companies

The declinist case for Intel ($INTC). (Quartz, Asymco)

It looks like AMD ($AMD) may have made a turn for the better. (The Verge)

Google ($GOOG) is increasingly becoming a trust-me story. (Pando Daily, Business Insider, The Exchange)

Washington Post ($WPO) purchased a maker of parts for industrial furnaces. (WSJ)

Does Pepsi ($PEP) need to respond to the idea of merging with Mondelez? (Breakingviews, WSJ)

Finance

The City of Detroit is officially bankrupt. (WSJ, Bond Buyer, NYTimes)

The continued case for the big banks. (The Brooklyn Investor)

Big investors are ramping up their hedge fund seed businesses. (WSJ)

Next week will be a big week for IPOs. (Term Sheet)

Global

Rob Arnott on why the emerging markets look attractive. (IndexUniverse)

Are UK stocks the best way to play a European rebound? (Humble Student)

The bull case for Japan. (FT)

Economy

Tapering need not imply tightening. (Tim Duy, FT Alphaville)

Do Fed Funds still matter? (FT Alphaville)

Don’t expect a tick up in the labor participation rate any time soon. (Calculated Risk)

Housing flipping is back. (Bloomberg)

“Looking for a job? Head west.” (Real Time Economics)

Earlier on Abnormal Returns

Don’t personalize the stock market. (Abnormal Returns)

Abnormal Returns was #18 on this list of the “100 Best Finance Blogs.” (Insider Monkey)

What you may have missed in our Thursday linkfest. (Abnormal Returns)

Mixed media

Swell is the Pandora for podcasts. (GigaOM)

Can Bookvibe mine your Twitter feed for book recommendations? (Bits)

The Internet is going behind a paywall. (Buzzfeed)

How the cellphone changed dating. (USA Today)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.