Quote of the day

Brian Lund, “Fighting the markets, despite the stories it provides you for social interaction, is the worst possible way to try to make money. Finding the style that works best with you personality while allowing you to benefit from the market’s moves is the ultimate win.” (bclund)

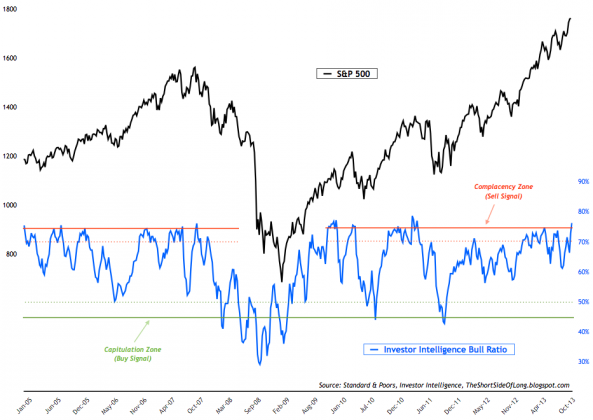

Chart of the day

Newsletter writers are wicked bullish. (The Short Side of Long)

Markets

US stock market volatility has evaporated. (Sober Look)

The case that the technology sector is in a bubble. (Business Insider)

Individual investors still seem to be huddled in cash. (The Reformed Broker)

What happens to a company’s stock price when the CEO goes on CNBC? (Turnkey Analyst)

Strategy

On the difference between performance calculation and measurement. (Portfolio Probe)

Fund managers hate commodities. (Market Anthropology)

Does your alternative asset class actually provide portfolio diversification? (Morningstar)

You can only experience information overload if you treat each piece of information uniformly. (The Reformed Broker)

Twitter ups its price range. (MoneyBeat)

What Twitter’s IPO means. (Quartz)

How Twitter ($TWTR) will change the way we advertise. (Andy Kessler)

Twitter has a big design and usability problem. (TechCrunch)

What is Twitter going to do with its new found cash? Acquisitions, of course. (FT)

IPOs

On the return of the Chinese IPO. (Dealbook)

Would you buy the Wix IPO? (Medium)

Finance

Algorithms continue to make inroads at hedge funds. (FT Alphaville)

How John Paulson made money this year. (FT)

Private equity is increasingly active in money managers. (FT)

The downside of equity crowdfunding. (Inc. also All About Alpha)

ETFs

What it takes to convert a hedge fund into a mutual fund. (WSJ)

On the attractions (or distractions) of covered call funds. (Barron’s)

Does the world need a ETF-based 401(k) plan? Charles Schwab ($SCHW) thinks so. (WSJ)

“Anchor clients” are now driving ETF construction. (IndexUniverse)

Do you really need to trade $TLT? (LearnBonds)

China

What are we to make of China’s stock market finally picking up? (Dynamic Hedge)

Howard Marks likes Chinese stocks. (Bloomberg)

Europe

Two reasons for pessimism for the Euro. (Fortune)

The ECB is increasingly having to deal with the zero lower bound. (Gavyn Davies)

Economy

What it would take for the Fed to taper in December. (Calculated Risk)

The structure of the corporate bond market if much different than it was prior to QE. (FT Alphaville)

The missed opportunity that is reduced US public infrastructure investment. (FT)

Earlier on Abnormal Returns

What books Abnormal Returns readers purchased in October 2013. (Abnormal Returns)

What you may have missed in our Sunday linkfest. (Abnormal Returns)

Mixed media

In praise of the power nap. (Tony Schwartz)

A more flexible power grid requires new standards. (GigaOM)

A rave review for Junheng Li’s Tiger Woman on Wall Street: Winning Business Strategies from Shanghai to New York and Back. (Reading the Markets)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.