Quote of the day

Carl Richards, “Diversification, in combination with our financial plan, helps us behave like adults by creating opportunities to buy low and sell high.” (Bucks Blog)

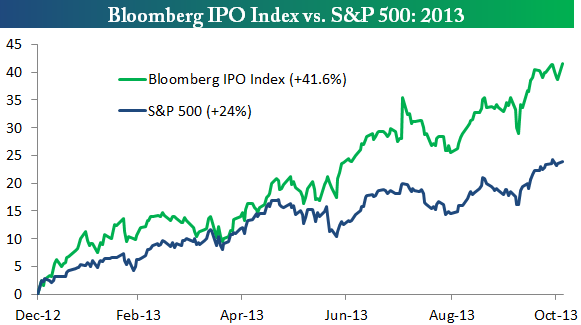

Chart of the day

Investors can’t seem to get enough of recent IPOs. (Bespoke)

Markets

Every S&P 500 sector is up at least 10% this year. (Business Insider)

How have the last two months of the year played out in big up years? (Avondale Asset, Mebane Faber)

Lower gasoline prices are here. (TheArmoTrader, Pragmatic Capitalism)

Gold miners: still oversold. (The Short Side of Long)

A more quantitative look at Warren Buffett’s favorite market indicator. (Turnkey Analyst)

Strategy

Fear is killing your investments. (Chuck Jaffe)

Swing traders need to understand industry momentum. (Ivanhoff Capital)

On the use of boxplots to show relative asset class performance. (Capital Spectator)

Your “consistent and repeatable” process is leading you down a blind alley. (the research puzzle)

Research

How to discount backtests due to data mining. (SSRN via @quantivity)

Do you want a PhD managing your money? (SSRN via CXOAG)

Finance

How Twitter ($TWTR) will change as a public company. (GigaOM)

The personalities behind Twitter are reflected in its nature according to Nick Bilton’s new book Hatching Twitter: A True Story of Money, Power, Friendship and Betrayal. (Wired)

Was justice done with SAC Capital? (James Stewart, Barry Ritholtz, John Cassidy)

What is private equity going do with their cash in a low-growth environment? (FT Alphaville)

ETFs

Lars Kroije author of Investing Demystified: How to Invest Without Speculation and Sleepless Nights thinks investors need to face a “simple truth.” (IndexUniverse)

Franklin Templeton ($BEN) is now in the ETF game. (IndexUniverse)

Global

Emerging market IPOs are returning to London. (MoneyBeat)

Is the Fed blowing bubbles in the emerging markets? (Wonkblog)

Huge fines are the new taxes. (FT Alphaville)

In defense of HFT. (Real Time Economics)

Economy

Why the Fed might move the goalposts on tapering. (Business Insider)

Where are the spillover effects of the Shale revolution? (Econbrowser)

Why the idea of rational expectations is important to economics. (Mark Thoma)

Earlier on Abnormal Returns

What you may have missed in our Monday linkfest. (Abnormal Returns)

Mixed media

Silicon Valley has an arrogance problem. (WSJ)

Is Bitcoin broken? (Hacking, Distributed via @thebrowser)

We are not alone. There are billions of Earth-like planets in the universe. (NYTimes)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.