On the bookshelf: Investing Demystified: How to Invest Without Speculation and Sleepless Nights by Lars Kroijer.

Quote of the day

Matt Cutts, “Back in the day, guest blogging used to be a respectable thing, much like getting a coveted, respected author to write the introduction of your book. It’s not that way any more.” (Matt Cutts)

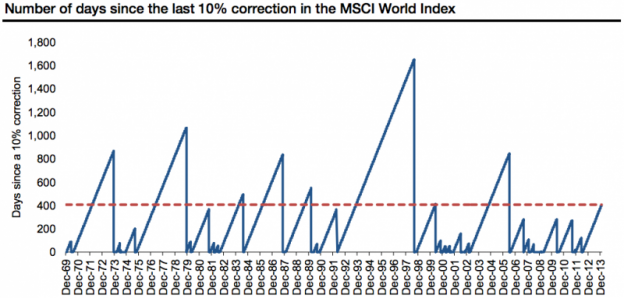

Chart of the day

It’s been awhile since a meaningful stock market correction. (Business Insider)

Markets

Four takeaways on asset class prices. (Big Picture)

It’s time for the consumer discretionary stocks to underperform. (Charts etc.)

Rising interest rates are not necessarily bad for stocks. (Horan Capital)

Strategy

The case against non-traded public REITs. (Strubel Investment Management via ValueWalk)

Investing with the Trend: A Rules-Based Approach to Money Management by Gregory L. Morris is “first rate.” (Reading the Markets)

The low volatility effect on mutual fund performance. (SSRN)

In praise of satisficing. (Bucks Blog)

Companies

Is Yahoo ($YHOO) worth saving? (Techpinions via @howardlindzon)

Dan Loeb wants Dow Chemical ($DOW) to break itself up. (FT)

Investors are craving capex. (MoneyBeat)

Finance

Wells Fargo ($WFC) does not want its employees to invest in P2P loans. (FT)

What pre-IPO CEOs need to know now. (Re/code)

Global

Evidence that Chinese are not all that crazy about the PBOC. (FT Alphaville)

Why bother with emerging market equities compared to emerging market bonds? (Market Anthropology)

Is Norway’s sovereign wealth fund playing it too safe? (Reuters)

Economy

Why the Fed may again reduce QE at its January meeting. (WSJ)

The US economy is “grinding forward.” (Tim Duy)

Earlier on Abnormal Returns

What you missed in our Monday linkfest. (Abnormal Returns)

Mixed media

Not every innovation is disruptive. (Slate)

Why Bitcoin matters. (Marc Andreeessen)

You are not your work. (A VC)

You can support Abnormal Returns by visiting Amazon. You can also follow us on StockTwits and Twitter.