You can keep up with all of our posts by signing up for our daily e-mail. Thousands of other readers already have. Don’t miss out!

Quote of the day

Joshua Brown, “After all, prices only loosely reflect fundamentals and spend the majority of the time trading at either reckless premiums or absurd discounts to them…should we really be expecting a stasis of reasonable valuation to be the norm for any appreciable stretch of time?” (The Reformed Broker)

Chart of the day

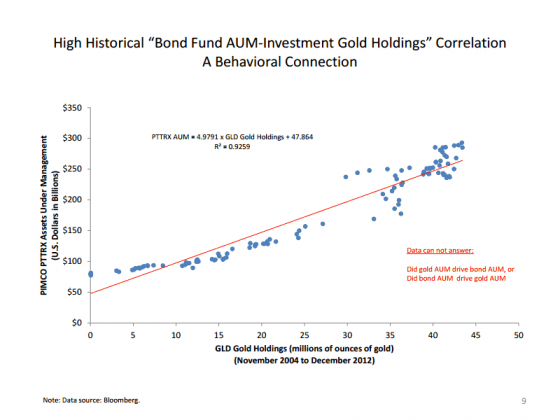

If gold benefits from inflation and bonds from deflation why did they move together so much? (Marketwatch, SSRN)

Markets

Portfolio managers are wicked bullish. (Fat Pitch)

Investors don’t like being told the stock market is overvalued. (MoneyBeat)

The two most bombed out trades right now. (Minyanville)

Watching managed futures? Look at volatility. (Attain Capital)

Bill Fleckenstein wants to short these two stocks. (Bloomberg)

Strategy

When will the pendulum swing back to active management? (The Reformed Broker)

2013 was another huge year for farmland. (ValueWalk)

Yet another example of politics clouding investment judgement. (Above the Market)

The anatomy of a trader’s mind. (MartinKronicle)

Did Google ($GOOG) overpay for Nest? (Dealbook)

Why Google had to buy Nest. (Barry Ritholtz)

IBM

What return has IBM ($IBM) shown on its massive share buybacks? (WSJ

A closer look at IBM’s earnings*. (Jeff Matthews, , Herb Greenberg)

Hedge funds

Hedge funds are getting the benefit of the doubt for now. (John Authers)

How the ‘delisting bias‘ affect hedge fund index returns. (IndexUniverse)

ETFs

Is too much money rushing into equity funds? (Rekenthaler Report)

The Fidelity-iShares tie-up has worked out well for everyone. (FT)

An ETF even your grandmother can love: the PowerShares NYSE Century Portfolio ($NYCC). (DailyFinance)

Global

How much slack is left in the UK economy? (FT Alphaville, Quartz)

The chart that explains recent global growth. (Business Insider)

Traders are way short the Canadian dollar. (Business Insider, BCA Research)

Economy

Private investment and where we are in the economic cycle. (Calculated Risk)

Financial stress is wicked low…for now. (FT Alphaville)

Estimating the risk of recession using the Treasury term spread. (Capital Spectator)

Earlier on Abnormal Return

What you missed in our Tuesday linkfest. (Abnormal Returns)

Mixed media

Harry’s wants to take on the world’s shaving giants. (Dealbook)

Want to have a good 2014? Cut out all your business trips. (Brad Feld)

Want to win $1 billion? Just pick a perfect March Madness bracket. (Fortune, Aleph Blog, Focus on Funds)

You can support Abnormal Returns by visiting Amazon. You can also follow us on StockTwits and Twitter.