On the bookshelf: Doug Short at Advisor Perspectives takes a look at Investing with the Trend: A Rules-based Approach to Money Management, by Gregory L. Morris.

Quote of the day

Mark Dow, “Gone is the fixed FX regime and original sin. Domestic EM financial markets are deeper. Reserves are higher. But don’t try and fight the old school and their anachronistic biases. They are bigger than you are.” (Mark Dow)

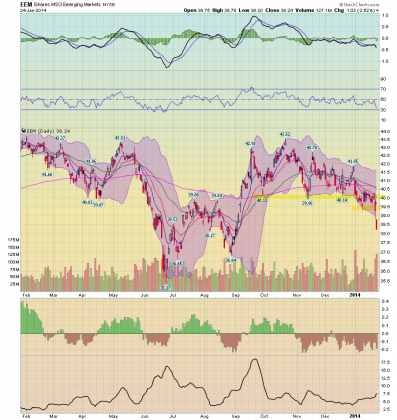

Chart of the day

A look at the emerging markets sell-0ff. (Bonddad Blog)

Markets

Global markets are starting to enter bear markets. (The Short Side of Long)

The market is a master manipulator. (Joe Fahmy)

Strategy

Behavior trumps investment strategy. (A Wealth of Common Sense)

Two examples of how investors are reading the news wrong. (Chuck Jaffe)

Why correlation doesn’t matter all that much. (Rick Ferri)

Why investors seem to be schizophrenic. (Phil DeMuth)

Advisors can have a big (positive) effect on investor returns. (ETF)

Media

ESPN is trying to go online without losing paying subscribers. (WSJ, GigaOM)

Digital journalism is different than print or video. (NYTimes)

Don’t confuse “long form” with substantial. (Marco Ament)

How do you effectively play the shift from TV to Internet advertising? (Phil Pearlman)

Finance

A periodic table of annual hedge fund strategy returns. (aiCIO)

Hedge funds of late have done no better than a 60/40 portfolio. (Motley Fool)

A ban on trader chat could put the hurt on Bloomberg. (Quartz)

ETFs

The new ETF.com opens up its analytics to the world for free. (ETF)

Beware ETF proliferation. (Focus on Funds)

Global

Why emerging markets are tanking. (Business Insider)

Politics is playing a big role in this emerging markets debacle. (Free exchange)

We will soon be able to sort the wheat from the chaff in the emerging markets. (Crossing Wall Street)

Foreign companies are having to adjust their China strategies. (Economist)

Will the UK be the first to raise benchmark rates? (Gavyn Davies)

Why the irrelevance of Davos is good news. (Felix Salmon)

Economy

Should the Fed worry about emerging markets? (MoneyBeat)

The housing sector can be a positive for the US economy for some time to come. (Quartz)

There are vast swaths of the United States where upward mobility is limited. (The Atlantic)

Assortative mating plays a big role in growing income inequality. (Marginal Revolution)

Earlier on Abnormal Returns

What you missed in our Sunday linkfest. (Abnormal Returns)

Mixed media

There is only one Twitter experience: only yours. (GigaOM also TechCrunch)

Keep an eye on people going to work for money-losing companies. (Above the Crowd)

Beware startups that claim to be “this for that.” (A VC)

You can support Abnormal Returns by visiting Amazon. You can also follow us on StockTwits and Twitter.