You can keep up with all of our posts by signing up for our daily e-mail. Thousands of other readers already have. Don’t miss out!

Quote of the day

BN, “But it is possible to recognise that technology can change the world without accepting that the big gains will come to investors; history suggests that consumers tend to receive most of the benefits in the form of lower prices.” (Buttonwood’s Notebook)

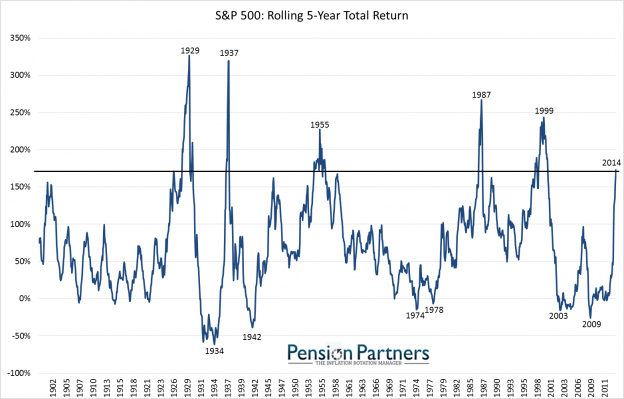

Chart of the day

Happy fifth anniversary to the most hated bull market ever. (Pension Partners)

Markets

Explaining the ‘relentless bid‘ theory. (The Reformed Broker also Adam Warner)

Valuations are at bull market highs. (Dr. Ed’s Blog)

Is gold just another commodity these days? (Pragmatic Capitalism)

Coal has been down so long… (All Star Charts)

Short volatility is a crowded trade. (FT Alphaville)

Strategy

Why you should be tilting towards global markets. (Meb Faber)

The case against life insurance as an investment. (Aleph Blog)

Why so many prominent investors are fans of Benjamin Graham’s The Intelligent Investor. (Bloomberg)

Companies

Is Costco ($COST) vulnerable to online competition? (Herb Greenberg)

Technology companies going public today are older and more successful than during the Internet bubble. (Bloomberg)

The ‘Achilles heel’ of the technology boom: conflicts of interest. (Howard Lindzon)

Finance

What Moelis & Co. plans to do with its IPO proceeds. (Bloomberg, Dealbook)

The story of renowned hedge fund manager Paul Tudor Jones in the latter part of his career. (Dealbook)

Stockbrokers are still not disclosing past issues. (WSJ)

Funds

Now ETF portfolio managers are roiling markets with their shifts. (WSJ)

A Q&A about manager selection with Brian Portnoy author of The Investors Paradox: The Power of Simplicity in a World of Overwhelming Choice. (Morningstar)

Three principles of successful index investors. (Rick Ferri)

Global

Value works in emerging markets, but it requires some additional work. (FT)

Are emerging markets more exposed to currency fluctuations than commonly thought? (FT Alphaville)

Economy

Weekly initial unemployment claims are encouraging. (Calculated Risk, Bespoke)

Why weak economic stats are unlikely to derail the taper. (Tim Duy)

Earlier on Abnormal Returns

Quick takes on five recently published finance-related books. (Abnormal Returns)

What you may have missed in our Wednesday linkfest. (Abnormal Returns)

Mixed media

Getty Images is making most of its pictures free to use. (The Verge, A VC)

MBAs saying no to tuition reimbursement. (WSJ)

The real reason the SAT is getting an overhaul. (Wonkblog)

Tuft & Needle is shaking up the hidebound mattress industry. (Re/code)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.