Quote of the day

Ron Lieber, “As with any investor, we simply cannot know ahead of time whether a high-performing mutual fund manager or investment adviser is lucky or smart, let alone whose smarts and luck will last for the half-century or more that we all intend to be investors.” (NYTimes)

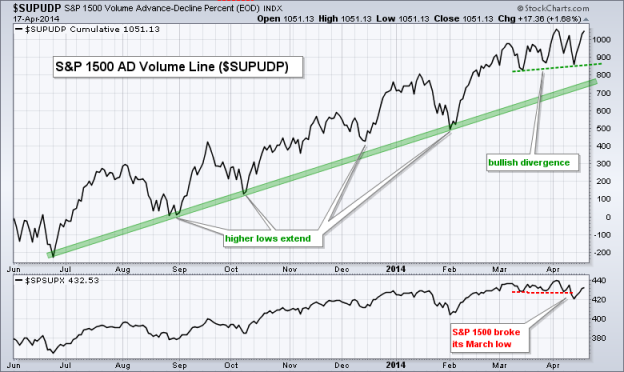

Chart of the day

Breadth help up pretty well during the correction. (StockCharts Blog)

Smart beta debate

Why smart beta funds are not a substitute for index funds. (Burton Malkiel)

All investors, despite their claims, are active to some degree. (Pragmatic Capitalism)

Four criteria by which you can evaluate any strategy: passive or active. (Millenial Invest)

Strategy

Jeff Miller, “Investing is not like a poker game, where you go “all in” or completely sit out.” (A Dash of Insight)

Floating rate Treasuries as a CD alternative. (Jason Zweig)

Sharing ideas leads to more ideas not less. (TraderFeed)

On the difference between shallow and deep risks. (A Wealth of Common Sense)

Finance

What I learned on the sell-side. (A Wealth of Common Sense)

The new realities of private equity. (McKinsey via @epicureandeal)

Recent venture capital funding has been “top-heavy.” (TechCrunch, Term Sheet)

Poison pills are no being used to fend off activist investors. (Dealbook)

ETFs

The definitive guide to 2014 ETF taxation. (ETF)

Global

What is going with UK home prices? (Sober Look)

Economy

Banks are beginning to ease their mortgage lending standards. (WSJ, ibid)

Signs that the US consumer is largely done deleveraging. (voxEU)

Does inflation make your poorer? (Noahpinion)

Rail traffic is once again headed higher. (Pragmatic Capitalism)

US heavy truck sales have been sluggish. (Calculated Risk)

A look back at the economic week that was. (Bonddad Blog, Big Picture)

The economic schedule for the coming week. (Calculated Risk, Turnkey Analyst)

Earlier on Abnormal Returns

Top clicks this week on the site. (Abnormal Returns)

Active vs. passive: try harder or do something easier? (Abnormal Returns)

Automated investment management as a transitional moment for advisors. (Abnormal Returns)

What you may have missed in our Saturday linkfest. (Abnormal Returns)

Mixed media

Cash money is dirtier than previously thought. (WSJ)

Passwords are obsolete. (Medium)

On the PhD glut. (Priceonomics)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.