Quote of the day

Ben Carlson, “One of the most important aspects of investing that most people don’t understand is that financial markets are always and forever cyclical. ” (A Wealth of Common Sense)

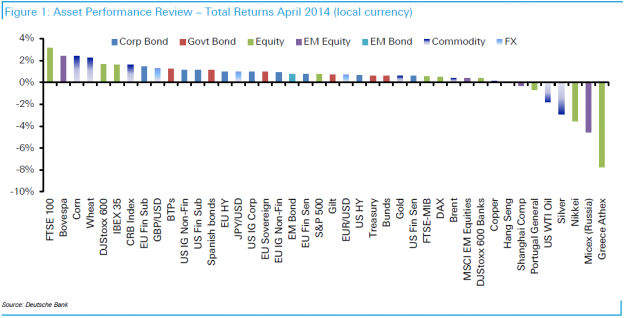

Chart of the day

Long London, short Athens: major asset class returns for April. (FT Alphaville, Capital Spectator)

Markets

Who killed market volatility? (Bloomberg View)

The yield on the 10-year Treasury has flatlined. (Bespoke)

Why you should lower your return expectations. (Humble Student)

Technology stocks have not responded well to earnings reports. (Bespoke, StockCharts Blog)

Why retail investors can’t direct their trades to the IEX. (CNBC)

Strategy

On finding your investing niche. (Clear Eyes Investing)

Why valuing growth stocks is so difficult. (Monevator)

No trading system works well every month. (ZorTrades)

Why picking active managers is so difficult. (Larry Swedroe)

Economic policy uncertainty doesn’t tell us much about stock returns. (Rick Ferri)

Technology

Microsoft ($MSFT) is technology’s “comeback kid.” (TechCrunch)

LinkedIn ($LNKD) is monetizing your data every which way and that. (Quartz)

T-Mobile ($TMUS) is winning the war for new customers. (Bloomberg, Business Insider, Re/code)

Does Twitter ($TWTR) regret going public? (Herb Greenberg, TRB)

On the strength of Apple’s ($AAPL) brand. (Vitaily Katsneleson)

SnapChat is moving beyond photos. (The Verge)

On the disconnect between American and Chinese internet companies. (Farhad Manjoo)

Companies

Hello Pfizer ($PFE): on the siren song of lower overseas taxes. (FT)

Don’t hold your breath for a surge in business investment. (Michael Santoli, Rational Irrationality)

Envisioning the end of employer-provided healthcare. (The Upshot)

Finance

Ten morning call commandments. (The Reformed broker)

Why don’t Wall Street stars get endorsement deals like athletes? (The Reformed Broker)

Not all activist investors are cut from the same cloth. (CNBC also SL Advisors)

Economy

Weekly initial unemployment claims ticked up last week. (Calculated Risk)

The April ISM manufacturing numbers were strong. (Bespoke)

Neil Irwin, “We obsess far too much on the Labor Department’s monthly jobs report.” (Upshot)

Redacted versions of the April 2014 FOMC statement. (Aleph Blog, Real Time Economics)

21 economic charts you should see from April. (Quartz)

The BPP is showing hotter inflation than the CPI. (Real Time Economics)

American teens are working less and less. (Marketwatch)

Earlier on Abnormal Returns

What you may have missed in our Wednesday linkfest. (Abnormal Returns)

Mixed media

HBO is still the best when it comes to monetizing original content. (Businessweek)

What John Oliver host of HBO’s Last Week Tonight reads. (The Wire)

HBO is bringing back Project Greenlight. (Deadline, The Verge)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.