You can keep up with all of our posts by signing up for our daily e-mail. Thousands of other readers already have. Don’t miss out!

Quote of the day

Ashby Monk, “I would argue that much of the wealth being accumulated at hedge funds is more a function of the governance deficiencies of pension funds than anything going on at hedge funds.” (Institutional Investor)

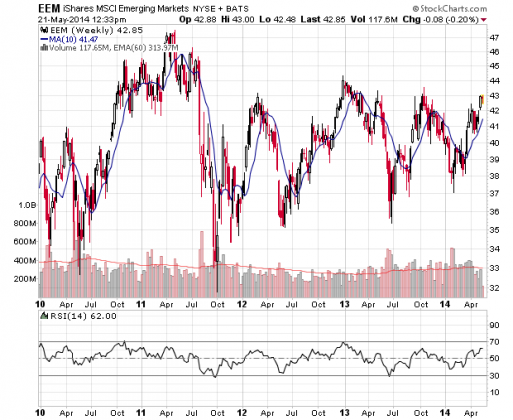

Chart of the day

Emerging markets have been moving sideways for years. (StockCharts)

Markets

A look at some other breadth measures. (Short Side of Long, Humble Student)

Investors are pouring money into palladium. (FT)

Strategy

You don’t understand risk. (Barry Ritholtz)

The case for active management. (Conor Sen)

Managed futures are a bit of a mess. (Peter Brandt)

Another robo-advisor FutureAdvisor has raised big venture capital money. (VC Dispatch, TechCrunch)

Companies

Blame Netflix ($NFLX), and video streaming in general, for the net neutrality debate. (Digitopology)

Cable companies are not exactly busting the bank on capital expenditures. (Justin Fox)

Finance

Private equity is increasingly putting the leverage in leveraged buyouts. (WSJ)

Big investors are reassessing the single family home trade. (WSJ)

P2P lending is becoming increasingly institutionalized. (FT Alphaville)

Why mutual funds are not “systemically important” institutions. (FT)

ETFs

When ETFs bite back: big index re-weightings. (Focus on Funds, Morningstar)

The ETF Deathwatch for May 2014. (Invest with an Edge)

Economy

Why didn’t non-financial profits fall further during the Great Recession? (Philosophical Economics)

The case for continued strong apartment growth. (Calculated Risk)

Financial illiteracy is a huge problem. (Marginal Revolution)

Earlier on Abnormal Returns

What you may have missed in our Tuesday linkfest. (Abnormal Returns)

Mixed media

A Fox Business fail. (Media Matters)

Masters degrees are the new bachelors degrees. (Vox)

James McManus, “Whether it happens on land or online, playing poker should no longer be considered a criminal act.” (Bloomberg View)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.