Quote of the day

Jim Saksa, “So what kinds of companies would ever want use non-accredited investor crowdfunding? Desperate ones.” (Slate)

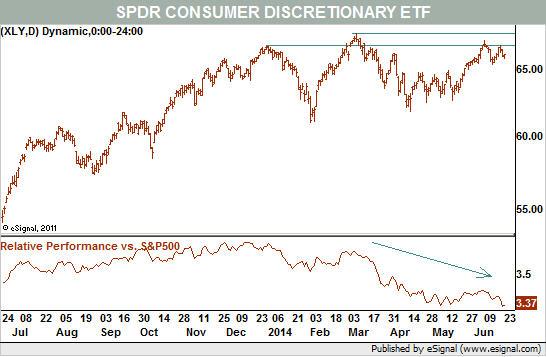

Chart of the day

Consumer discretionary stocks have been underperforming all year. (Barron’s)

Markets

The market of late has been eerily quiet. (Business Insider also Irrelevant Investor)

Energy stocks are overbought. (Andrew Thrasher, Bespoke)

Stock buybacks are proving fuel for the bull. (Dr. Ed’s Blog)

Let the silly season begin. (FT Alphaville)

The stock market rally caught institutional investors flat-footed. (WSJ)

Strategy

How losing traders think. (Chicago Sean)

Why cap-weighting doesn’t work. (Morningstar)

Norway’s sovereign wealth fund is expanding its reach. (Bloomberg)

William Bernstein

Do you really need international bonds in your portfolio? (ETF)

A Q&A with William Bernstein author of Rational Expectations. (Forbes)

Companies

Finance

Do high frequency traders actually extract liquidity from the equity markets? (FT)

When short-sellers attack. (SL Advisors)

The tough road short-sellers have to follow. (Noah Smith)

ETFs

Bond fund flows have been a one-way street post-crisis. What happens when mom and pop head for the door? (Bloomberg)

Smart beta: smart (who knows?), beta (yes). (Cassandra Does Tokyo)

Under what circumstances will smart beta work? (Aleph Blog)

Economy

New home sales are surging. (Bloomberg, Calculated Risk)

Is the reality of student debt all that different today? (The Upshot)

A look at the dove/hawk split on the Fed. (Gavyn Davies)

Oil and the real economy. (Econbrowser, AlphaNow)

Earlier on Abnormal Returns

What you might have missed in our Monday linkfest. (Abnormal Returns)

Mixed media

Seven summer books your should read including Scarcity: Why Having Too Little Means So Much by Sendhil Mullainathan and Eldar Shafir. (Morgan Housel)

On the economics of paying workers to quit their jobs. (The Week)

The way we find apps is broken. (Medium)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.