Quote of the day

Adam Grimes, “Daytrading is probably harder than you think and your chances of success, for any number of reasons, are a lot slimmer than you think” (Adam Grimes)

Chart of the day

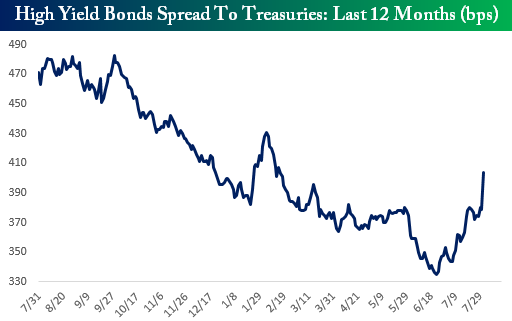

High yield bonds are now yielding more. (Bespoke)

Markets

2% market drops are not all that rare. (A Wealth of Common Sense also Random Roger)

The consumer stocks are getting hit hard. (Irrelevant Investor)

Keep an eye on the relative weakness of high yield bonds. (TraderFeed also WSJ)

A review of major asset class performance for July. (Capital Spectator)

Why interest rates could stay lower, longer. (Market Anthropology)

Strategy

The secret to trading is that there is no secret. (ZorTrades)

A little neglect is good for stock pickers. (Aleph Blog)

Companies

Four myths about Amazon ($AMZN). (Marketwatch)

Just who is the biggest cloud computing company? (GigaOM)

Electric utilities are now dealing with the issue of demand destruction. (Slate)

ETFs

Even die-hard index investors don’t invest 100% in index funds. (Rick Ferri)

A deep dive into the underperformance of hedge fund strategies. (FT Alphaville)

Should you buy an ETF with stocks owned by billionaires? (Chuck Jaffe)

Global

Chinese stocks are now leading US stocks. (Short Side of Long)

Can investors really just write off Russia? (FT Alphaville)

Economy

The US economy added 200k jobs for the six month in a row. (Calculated Risk, Real Time Economics, Bonddad Blog, Carpe Diem, FiveThirtyEight)

The ISM manufacturing numbers for July showed continued strength. (Bespoke, Calculated Risk)

FRED

Meet the people behind FRED. (Washington Post)

And the charts some policy types love on FRED. (Washington post)

Earlier on Abnormal Returns

There really has never been a better time to be an individual investor. (Big Picture)

What you might have missed in our Thursday linkfest. (Abnormal Returns)

Mixed media

Here’s wishing a happy blogiversary to Robert Seawright. (Above the Market)

On the many lessons in Joshua Brown and Jeff Macke’s Clash of the Financial Pundits. (Canadian Couch Potato)

You can support Abnormal Returns by visiting Amazon. Don’t forget to follow us on StockTwits and Twitter.