Quote of the day

Ineichen Research, “Diversification is for those who know what they don’t know. All other investors either don’t know what they don’t know or bought into a potentially false doctrine from which the only cure is substantial losses.” (Virtus via @derekhernquist)

Chart of the day

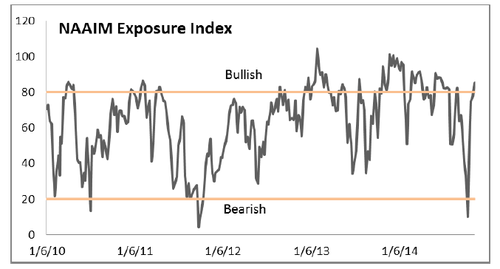

Another example why you should have a disciplined portfolio rebalancing process. (Humble Student)

Strategy

Investors have fled inflation-protection this year. (FT)

Once more with feeling: the S&P 500 is NOT “the market.” (Pragmatic Capitalism)

Markets having a problem pricing companies with earnings seasonality. (Alpha Architect)

Quotes

Eddy Elfenbein, “Markets tend to move between long periods of stability and short periods of great instability.” (Crossing Wall Street)

Dan Zanger, “You’ll learn more from your losers than your winners will ever provide.” (Finance Trends Matter)

Adam Grimes, “Some people get lucky in the market and some don’t.” (Adam Grimes)

Companies

It’s not all about market share: why producers, like Taylor Swift and Apple ($AAPL), should try to capture value from their work. (stratechery)

$75 oil makes shale oil unprofitable. (Bloomberg)

Amazon’s ($AMZN) push into robots is paying off. (WSJ)

Junk bonds

Have we reached peak junk bond underwriting? (Bloomberg)

Signs of froth are apparent in the junk bond market. (Dealbook)

Funds

The four direct costs of ETF ownership. (ETF)

Vanguard has been crushing the competition. (The Reformed Broker)

On the difference between an investment firm and marketing firm. (A Wealth of Common Sense)

How important is manager tenure to fund selection? (Pieria via FT Alphaville)

The asset management industry is a study in contrasts: falling fees at the margin and continued high fees for elite funds. (Barry Ritholtz)

Economy

Layoffs are still stuck below 300,000 per week. (Calculated Risk, Bespoke)

Manufacturing is weakening around the globe. (Bespoke)

Now it is spilling over to the US. (Capital Spectator)

Earlier on Abnormal Returns

A perfect example of the behavior gap at work. (Abnormal Returns)

Should you buy what Tony Robbins, author of Money: Master the Game is selling? (Abnormal Returns)

Finance and digital journalism: the Charlie Rose edition. (Abnormal Returns)

What you might have missed in our Wednesday linkfest. (Abnormal Returns)

Mixed media

Two American companies are leading the US watch manufacturing renaissance. (Quartz)

A review of the “untapped potential” of the iPad Air 2. (Six Colors)

Why you should skip in-flight wi-fi. (Tim Maurer)

You can support Abnormal Returns by visiting Amazon, signing up for our daily newsletter or following us on StockTwits, Yahoo Finance and Twitter.