There is an interesting article at InvestmentNews by Trevor Hunnicutt that looks at the rise (and fall) of the Mainstay Marketfield fund. This fund was one of the first well-marketed, so-called alternative asset fund. Hunnitcutt documents the funds strong performance, subsequent surge in assets and recent fall from grace. Recent poor performance has led to a rush of outflows.

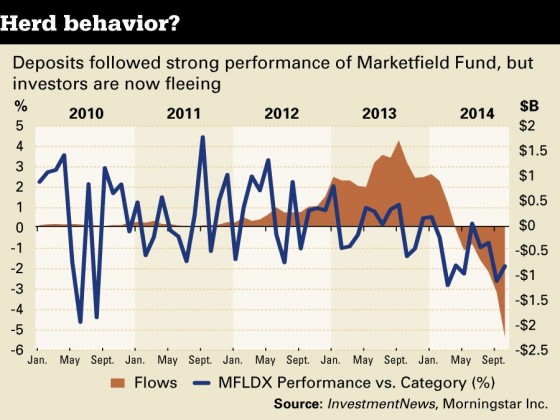

The chart below from InvestmentNews perfectly illustrates investor tendencies to rush into a fund (or asset class or strategy) only after it has demonstrated strong performance. You can read the full article to get the details about how the Marketfield fund rose to the top of the pack but the chart below tells the tale.

Source: InvestmentNews

You can actually quantify the difference, or behavior gap, between the headline returns on a fund and what investors actually earn dollar-wise. Adam Zoll at Morningstar discusses this topic in a post looking at the difference between total returns and investor returns. Zoll writes:

Many investors are their own worst enemies when it comes to trying to time their investing decisions. They jump into funds that have been on a hot streak just in time to experience the fizzle or they bail on funds that have experienced punishing downturns and miss out when they rebound. Investor return captures this real-world investor experience for each fund.

You can see how this played out for investors in the Marketfield fund in the chart from Morningstar below. You can see how fund investors have actually performed relative to the headline returns. In short, poorly.

Source: Morningstar

Ben Carlson at A Wealth of Common Sense talks about the importance of career risk when thinking about active management. There are two effects at play here. The first of course is investment behavior, usually ill-timed. Also we need to keep in mind how performance (good or bad) and investor flows feedback on manager behavior. For successful outcomes we need to see good behavior from both parties which is rare. Carlson writes:

It’s rare to have good behavior at the same time from both investors and portfolio managers. It’s not impossible, but it’s rare. The due diligence process required to choose active managers is not easy, especially for the average investor. But even if you have a legitimate process in place to find superior funds, you still have to manage your own emotions and place realistic expectations on the strategies you choose to be able to see them through a full cycle.

We spend much of our time in the financial media and blogosphere searching out new and novel strategies in the hope of generating alpha for ourselves and clients. However our behavior weighs far more heavily on performance than any fund or strategy ever can. Michael Batnick at the Irrelevant Investor notes this in a post discussing the hype around so-called smart beta strategies of late. He shows that sticking with any of these strategies over time would have outperformed the S&P 500. The only way to lose with these strategies was to try and jump from winner to winner. Batnick writes:

The key is to find a strategy that you can live with; something that meshes with your investing DNA. Jumping from strategy to strategy is guaranteed to lead to poor returns.

Unfortunately investors just can’t help themselves. There is something hard-wired in us to want to chase winners. Phil Pearlman notes:

Chances are, if you have an active advisor running some of your hard earned savings, he/she was selling into the decline and then chasing the rally. My takeaway here is not that RIAs are abnormal collectively. They’re not. On the contrary, maniacal market participant behavior is perfectly normal.

The challenge for investors is therefore two-fold. First to recognize that we all have this tendency. It is easy to note this tendency in others. It is harder to recognize it ourselves. Second we need to put in place strategies that we can follow over time. As I have noted previously it is far better to have a plan, even a sub-optimal one, that you can stick with than having no plan at all.