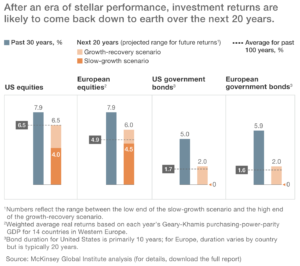

It may not seem like it but the past 30 years have seen above historical average returns for both the equity and especially the bond markets. The fine folks at McKinsey recently put out a report warning investors that these types of returns are unlikely to continue going forward. Below you can see a chart from the full report detailing their 20-year return expectations relative to history.

Source: McKinsey Global Institute

Rather than boring you with my own redundant thoughts on this report here are some novel insights from some of our favorite bloggers.

- Prediction: Forecasting anything, let alone, financial market returns 30 years hence is a fool’s errand. Barry Ritholtz notes that relying on a historical analogue is, at best, a simplifying assumption. In short, don’t be surprised if these forecasts end up being off the mark. (Bloomberg)

- Millennials: Many of the headlines about this reported touted this as bad news for Millennials. Ben Carlson notes that average returns are often misleading. Millennials would do best if returns stayed low while they built up their portfolios and then accelerate. (A Wealth of Common Sense)

- Portfolio: There is nothing altogether all that controversial in the report. Cullen Roche that a logical response to lower future returns are perfectly in sync with how one should be managing your portfolio anyway. This includes focusing on lowering your fees and taxes and being careful to reach for yield. (Pragmatic Capitalism)

- Emerging Markets: One thing McKinsey did was focus on the US and Europe. This omits the potential returns from investing in emerging markets. One can easily argue like Nir Kaissar did that emerging markets represent the best opportunity for future returns. (Bloomberg)

- Mergers: Academic studies have shown that historically acquisitions have not turned out well for acquiring companies. The McKinsey study estimates that investors have lost 1.8% per annum due to poorly performing mergers. (Marketwatch)

- You can also read more related posts from Monevator, Time, The Attain Alternatives Blog and A Wealth of Common Sense.

Then again nothing in the McKinsey Global Institute report should come as all that surprising to any one closely following the financial markets. Back in January we noted in a post the strong recent performance of a 60/40 portfolio. We also noted how that performance would likely drop off in part given the already steep decline in interest rates.

Forecasting the future is difficult for anyone, even the folks at McKinsey. That being said planning for a future of relatively muted returns does not hold a lot of downsides for the investor. A higher savings rate, an emphasis on low costs and a well thought out portfolio will serve you well in the future. So if the future turns out brighter than expected you will be all that much farther ahead of the game.