During this holiday-shortened week rather than bringing you fresh links I wanted to highlight what I call “criminally overlooked blog posts.” Every blogger will tell you that the correlation between what they think is a good blog post and what gains traction is close to zero. That is why I want to revisit some posts that are worth a second (or first) look. I asked a panel of esteemed bloggers to send me links to blog posts, their own or others, that got overlooked over time. All of today’s posts reflect on the issue of portfolio management. Stay tuned each day this week for a fresh batch of posts.

“The 13F report is an unhelpful and costly exercise. Those who take it seriously may well do the wrong thing.” by Jeff Miller from Government Reports from Big-Money Investors: Three Things You Need to Know (but don’t).

“The thing to keep in mind is that risk is very contextual. Everybody comes from a different background or is currently working through a different situation. What’s risky for one person may not be risky for another. Perhaps trying to define risk is the wrong pursuit.” by Daniel Sotiroff from Defining Risk.

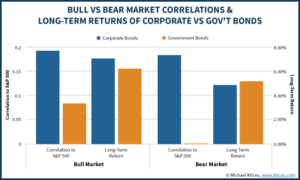

“While it’s commonplace for investors to hold multiple investments in a portfolio – often comprised of mutual funds or ETFs that in turn hold dozens or even hundreds of underlying positions – the reality is that even multi-asset-class portfolios aren’t always really diversified.” by Michael Kitces from Stress Testing To Ensure You Really Have A “Diversified” Portfolio?

Source: Nerd’s Eye View

“Rather than agonizing over passive vs active, CAPE vs forward P/E, or what have you, – investors should focus more their energies on ensuring that the conditions and policies that have proven best for shareholder returns continue because absent these conditions and policies, none of the minor details will matter anyway.” by Lawrence Hamtil from Stocks for the Long Run?

“Maybe it took you a little longer to get here than others, but using ETFs will fundamentally change the way you invest…You simply get diversified exposure to stocks, bonds, or commodities with as little friction as possible. That’s the bottom line.” by David Fabian from 5 Tips For Getting Started With ETFs.

“Don’t

fightspend too much time worrying aboutthe Fedany central bank.” by Phil Huber from Fun With Strikethroughs: Wall Street Maxim Edition.

You can also check out yesterday’s batch of criminally overlooked blog posts on investment philosophy as well.