Book notes

Tim Wu author of The Attention Merchants: The Epic Struggle to Get Inside Our Heads “We have to get over our addiction to free stuff. Suck it up and pay.” (The Atlantic)

Quote of the day

Ben Carlson, “Successful long-term investing is about learning to say no over and over again by developing a filter that helps you turn down more investment ideas than you accept.” (A Wealth of Common Sense)

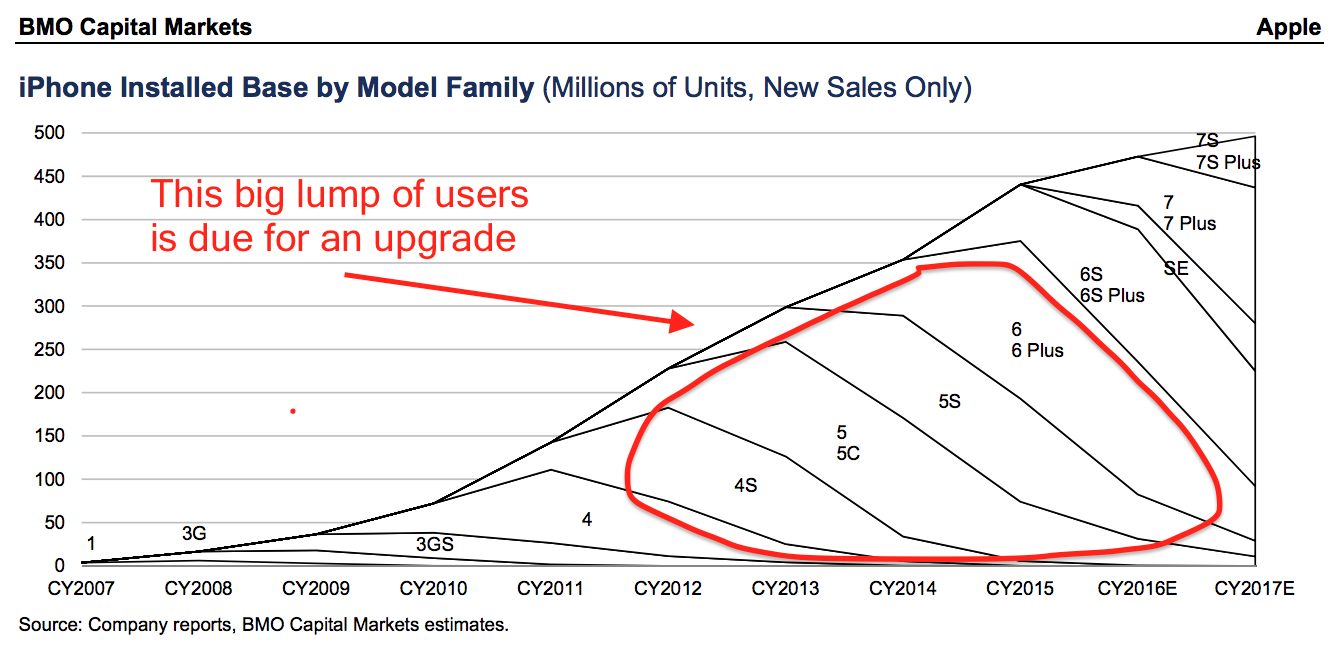

Chart of the day

There are a bunch of aging iPhones that need to get upgraded next year. (Business Insider)

Markets

Commodities were a rare loser last week. (Capital Spectator)

Strategy

Correlations don’t last forever. (The Reformed Broker)

Interesting and actionable are not the same thing. (Bason Asset)

What kind of drawdown are you willing to endure? (Portfolio Charts)

Offers

If you’ve read Thinking Fast and Slow you will likely want to read Michael Lewis’ forthcoming The Undoing Project: A Friendship That Changed Our Minds. (amazon.com)

Try Audible.com and get two free audiobooks including the new memoir byBruce Springsteen, Born to Run. (amazon.com)

Companies

The ghost of AOL will haunt the AT&T ($T)-Time Warner ($TWX) deal. (Recode)

The AT&T ($T)-Time Warner ($TWX) deal isn’t about consumer choice. (Dealbook)

Traders are skeptical the AT&T ($T)-Time Warner ($TWX) deal is going to happen. (Business Insider)

Netflix ($NFLX) is burning cash. (Bloomberg)

Netflix ($NFLX) to issue $800 million in bonds. (TechCrunch)

Finance

TD Ameritrade ($AMTD) is buying Scottrade. (Reuters)

Funds

Some off-the-beaten-path ETFs. (The Irrelevant Investor)

They’ll pretty much let anyone run an ETF these days… (Crossing Wall Street)

What would a world with too much indexing look like? (Aleph Blog)

Global

Investors are betting on increased fiscal stimulus next year. (WSJ)

Demographics are all pushing the world towards slower growth. (Gavyn Davies)

Economy

The Chicago Fed National Activity Index continues to indicate growth. (Capital Spectator)

Earlier on Abnormal Returns

Research links: playing the long game. (Abnormal Returns)

What you missed in our Sunday linkfest. (Abnormal Returns)

Mixed media

The MBA has become a tough sell to potential students. (FT)

MBA students should “look for plentiful work, not increasingly scarce jobs.” (HBR)