Each month we like to round-up all of our book-related links. You can also check out the previous edition of this linkfest, or our latest monthly (December) post of the most popular books among Abnormal Returns readers. Remember anything you buy from Amazon through these links goes to support the site. Enjoy!

Each month we like to round-up all of our book-related links. You can also check out the previous edition of this linkfest, or our latest monthly (December) post of the most popular books among Abnormal Returns readers. Remember anything you buy from Amazon through these links goes to support the site. Enjoy!

Finance

Recommendation: Larry Swedroe strongly recommends Jim Lange’s new book The Ultimate Retirement and Estate Plan for Your Million-Dollar IRA. (ETF)

Review: “The Index Revolution belongs on the reading list of anyone grappling with the choice between active management and passive investing.” (Enterprising Investor)

Review: Hedge Fund Investing: A Practical Approach to Understanding Investor Motivation, Manager Profits, and Fund Performance by Kevin R. Mirabile is a “thorough yet practical textbook.” (Enterprising Investor)

Review: The Laws of Wealth: Psychology and the Secret to Investing Success by Daniel Crosby makes the case for “rule-based behavioral investing to help defeat behavioral risk.” (Reading the Markets)

Review: Part one of a positive review of The End of Accounting and the Path Forward for Investors and Managers by Baruch Lev and Feng Gu. (Chicago Boyz)

Non-finance

Book list: 16 favorite books from 2016 including Neil Gaiman’s The View from the Cheap Seats. (Brain Pickings)

Best of: The 16 best books of 2016 including Sapiens: A Brief History of Humankind by Yuval Harari. (Farnam Street)

Review: Michael Lewis’ The Undoing Project: A Friendship That Changed Our Minds “captivated” both Cass Sunstein and Richard Thaler. (New Yorker)

Best of: The best books Ben read in 2016 including Judd Apatow’s Sick in the Head: Conversations About Life and Comedy. (A Wealth of Common Sense)

Reading list: A holiday reading list including The Power Paradox: How We Gain and Lose Influence by Dacher Keltner. (Pender Funds)

Best of: A good best of 2016 list including I Contain Multitudes: The Microbes Within Us and a Grander View of Life by Ed Yong. (The Mission)

Book list: B-school profs pick their favorite books including Jonah Berger’s Invisible Influence: The Hidden Forces That Shape Behavior. (FT)

Best of: The ten best business books of 2016 including Whiplash: How to Survive Our Faster Future by Joi Ito and Jeff Howe. (Fast Company)

Review: After a shaky start Michael Lewis’ The Undoing Project eventually becomes “vivid, original and hard to forget.” (Tim Harford)

Review: Ben Casnocha thinks that Chuck Klosterman’s But What If We’re Wrong: Thinking About the Present As If It Were the Past is “one of the most stimulating books that I read in 2016.” (Ben Casnocha)

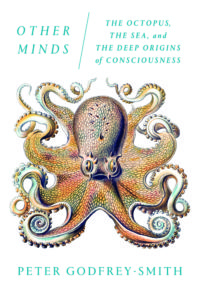

Review: Octopuses have been here on Earth 1000 times as long as humans. A nice review of The Octopus, the Sea, and the Deep Origins of Consciousness by Peter Godfrey-Smith. (NYTimes)

Lessons: Five lessons learned from Ryan Holiday’s The Obstacle is the Way: The Timeless Art of Turning Trials into Triumph. (Business Insider)

Review: Scratch: Writers, Money, and the Art of Making a Living edited by Manjula Martin shows how hard it is to talk about money. (Slate)

Review: Becoming Wise: An Inquiry into the Mystery and Art of Living by Krista Tippett is a search for a more meaningful life. (Farnam Street)

Review: Gary Taubes in The Case Against Sugar wants to convince you that sugar kills. (The Atlantic)

Notes: The Underground Culinary Tour: How the New Metrics of Today’s Top Restaurants are Transforming How America Eats by Damian Mogavero on the high expectations of diners today. (Bloomberg)

Excerpt: Other Minds: The Octopus, the Sea and the Deep Origins of Consciousness by Peter Godfrey-Smith explores what the octopus “brain” tells us about our own. (Scientific American)

Notes: 15 insights from James Altucher’s new book Reinvent Yourself. (Ivanhoff Capital)

Review: Kenny Aronoff has drummed with pretty much everyone in rock ‘n roll. What he learned along the way in Sex, Drums and Rock ‘n Roll: The Hardest Hitting Man in Show Business. (Big Picture)

Please check in with us on February 1st when we highlight the best-selling books on the site from January.