“There’s a psychological principle called ‘social influence.’ Which is basically a fancy way of saying peer pressure. It says that in a world of transparent tastes, simply knowing what’s popular will make you gravitate towards to those popular things. Knowing what the best-selling mop is will bound your search on Amazon to the most-popular mop. The same thing is happening for cultural products. Tastes are transparent now.” – Derek Thompson author of Hit Makers: The Science of Popularity in an Age of Distraction on Slate Money

“There’s a psychological principle called ‘social influence.’ Which is basically a fancy way of saying peer pressure. It says that in a world of transparent tastes, simply knowing what’s popular will make you gravitate towards to those popular things. Knowing what the best-selling mop is will bound your search on Amazon to the most-popular mop. The same thing is happening for cultural products. Tastes are transparent now.” – Derek Thompson author of Hit Makers: The Science of Popularity in an Age of Distraction on Slate Money

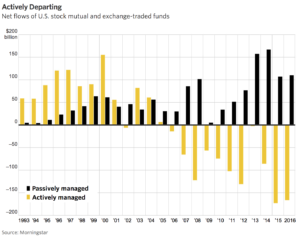

I would argue the same could be said for investment products as well. I am not sure when it happened but at some point index funds became the ‘most popular mop on Amazon.’ It use to be the case that mutual fund managers, like Peter Lynch, were the stars of the investment world. However ever since the end of the global financial crisis index funds (and ETFs) have become the default investment for individual investors. The graph below shows this trend quite clearly.

Source: WSJ

Stories that highlight the rise of index powerhouse Vanguard Investments reaching $4 trillion in assets under management, the continued rise of automated investment solutions that rely on index ETFs and the identification of indexing with “evidence based investing” all serve to reinforce this idea of indexing as the dominant investment theme. While past performance used to be the main criteria for picking funds now fund expenses are the main concern.

Once entrenched these social influence-backed norms are hard to dislodge. There are some legitimate concerns that index funds will someday mess with market efficiency by “locking in” today’s valuations. My guess though is that we are still far away from that concern becoming reality. So for now the shoe is on the other foot. Anyone today recommending actively managed funds needs not only to come up with a valid argument but must also overcome the social norm that now reinforces the idea of index investing.