Simple insights into investing are hard to find. Usually they rely on arithmetic as opposed to econometrics. For example, the insight from William Sharpe on the arithmetic of active management is straightforward:

Simple insights into investing are hard to find. Usually they rely on arithmetic as opposed to econometrics. For example, the insight from William Sharpe on the arithmetic of active management is straightforward:

Properly measured, the average actively managed dollar must underperform the average passively managed dollar, net of costs. Empirical analyses that appear to refute this principle are guilty of improper measurement.

Jack Bogle at Vanguard states this insight as the “cost matters hypothesis”:

Whether markets are efficient or inefficient, investors as a group must fall short of the market return by the amount of the costs they incur.

Both of these statements rest on logic and pretty simple math. The challenge for investors wading into the morass that is factor investing is that things are not quite so simple. One reason is that we don’t really have all that much independent data. Maybe with 10,000 years of data we could say some things with precision. But we don’t have that luxury.

There is too much incentive for researchers to publish data, and subsequently build an investment strategy on top of their findings. That is why anyone who wants to explore (and invest) in factor or multi-factor strategies would do well to not only have empirical evidence for their strategy but some economic intuition behind it as well.

That is why I have been intrigued by the low-vol effect for nearly the entire run of this blog and wrote about in my non-bestselling book. In the media, much has been made about the relative performance of low-vol strategies during this bull market.

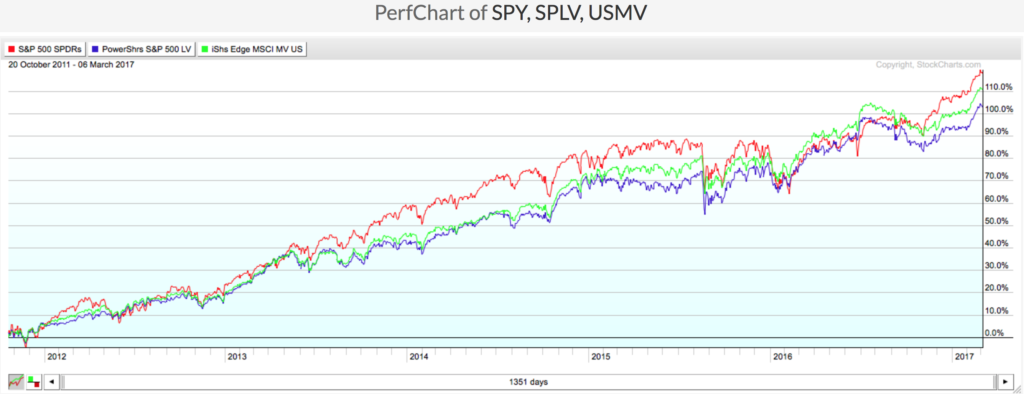

Below you can see the performance of three ETFs over the past six and half years: the SPDR S&P 500 ($SPY), the PowerShares S&P 500 Low Volatility ETF ($SPLV) and the iShares MSCI Minimum Variance ETF ($USMV). As you can see the performance has been pretty similar over this period. Guess what? It proves nothing.

Source: StockCharts.com

In fact we have seen this movie before. Back in 2012 there was a great deal of attention paid to the performance of low vol (here, and here). But here we are again arguing about the performance of low-vol once again. This just goes to show the mismatch in the time frames between the media and most investors. Unfortunately the introduction of the low volatility ETFs has now become conflated with the low volatility effect. The challenge is that the low volatility effect was found far before the introduction of these ETFs and is more widespread.

In January I missed a rare blog post by Eric Falkenstein at Falkenblog. In it he reviews the new book by Pim van Vliet and Jan de Koenig entitled High Returns from Low Risk: A Remarkable Stock Market Paradox. I will leave you in the capable hands of Falkenstein to explain the intuition and reasoning behind the low-vol effect.

Really the low-vol effect should be called the high-risk anomaly. This is because the relative outperformance of low volatility stocks is premised on the the underperformance of the high-vol, beta, etc. stocks. This relationship can be seen in the chart from the book:

Source: High Returns from Low Risk: A Remarkable Stock Market Paradox

Like the relationships mentioned at the beginning of this post, the math of the low-vol is straightforward. For any number of reasons investors seem to be exceedingly willing to bet on high risk stocks. From an investor standpoint it really doesn’t matter why. All that matters is that they do. This makes the risk-return “frown” work in the favor of investors willing to make a bet on this relationship continuing.

While the low-vol effect has a lot going for it, van Vliet believe that it should be used in conjunction with other well-established factors. Nor should we concerned that the introduction of single-factor ETFs will lead to the eradication of true anomalies. Falkenstein writes:

Investors would be wise to follow simple rules for investing. Those with the humility that comes from wisdom will be relieved to know that they can optimize their investments by merely focusing on lower-than-average risk stocks that make money, generate dividends, and have performed well. Those who need the advice most—average equity investors—are least likely to take it, so I am not worried that a regime shift is in play.

Investing isn’t simple (or easy). However simple rules give investors the best shot at establishing a framework for investing that has the chance to work today and in the future. As these things go the low-vol effect, or high-risk anomaly, are simple enough to understand and easy enough to implement.