One of the valid reasons to get into the investment industry is that constantly in flux. This requires successful practitioners to constantly learning. This may seem a bit like a cliche but it really is valid. For example we are in a time where indexing could comprise 50% of assets under management. Even a couple of years ago this idea would have seem far-fetched. Now we are talking about whether the entire passive investing movement has gone too far.

The point is that in the investment world things change and if you don’t keep learning you are going to feel left behind. The challenge for many people, in all fields, not just investing is that this learning process can make us feel inadequate. In part, because we know there is always more to learn.

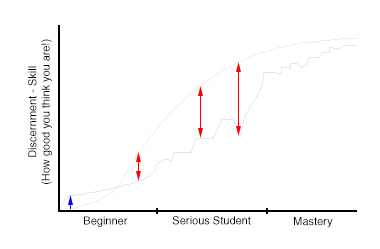

Adam H Grimes in his eponymous blog a few days ago captured this idea graphically showing why much of the time we feel like we are getting worse when if fact we are still progressing. Grimes notes this feeling of backtracking is why many people quit their chosen endeavor. He continues:

Adam H Grimes in his eponymous blog a few days ago captured this idea graphically showing why much of the time we feel like we are getting worse when if fact we are still progressing. Grimes notes this feeling of backtracking is why many people quit their chosen endeavor. He continues:

Forewarned is forearmed. If you know that this will likely happen, that you will hit plateaus and they’ll feel worse than they are, that you may feel stuck at a level for months (or even years), you’ll be prepared for it. You’ll understand that it is a normal part of skill development, and, most important, you will not quit. The path to mastery is difficult at best, but our perception of our own skill can shape the emotional context and lead to our eventual success or failure.

I realized that this phenomenon is closely related to the idea of “imposter syndrome.” In short, the idea that our achievements are not in fact our own and are due to other factors like luck. Imposter syndrome, or the imposter phenomenon, can lead to some debilitating actions. Kristin Weir at the APA writes:

Most people experience some self-doubt when facing new challenges, says Lieberman. “But someone with [imposter phenomenon] has an all-encompassing fear of being found out to not have what it takes.” Even if they experience outward signs of success — getting into a selective graduate program, say, or acing test after test — they have trouble believing that they’re worthy. Instead, they may chalk their success up to good luck.

The impostor phenomenon and perfectionism often go hand in hand. So-called impostors think every task they tackle has to be done perfectly, and they rarely ask for help. That perfectionism can lead to two typical responses, according to Clance. An impostor may procrastinate, putting off an assignment out of fear that he or she won’t be able to complete it to the necessary high standards. Or, he or she may overprepare, spending much more time on a task than is necessary.

Luck clearly plays a role in success and especially in trading and investing. But if you let imposter syndrome take over your consciousness you are setting yourself up for additional psychological pain. That is why it is important to recognize where you are on your journey and recognize that there are going to be bumps along the way. L.V. Anderson at Slate writes that putting a name to it we can lessen the power of these feelings:

And Clance and Imes have done the world a service by identifying and describing impostorism: Simply learning that impostor syndrome is a thing, and that lots of people experience it, can be helpful in lessening impostorism’s intensity (for most people). “Many people can live with it, and it changes as they get experience in a job,” says Clance. “Often knowing that a lot of other people experience it is helpful.”

Nearly everyone who has accomplished something feels like they don’t deserve it and feel like it could all be taken away. You are not alone in your feelings. Everyone is on a journey and recognizing that you are not all that unique should serve as some comfort.