Much of what we see written about investing is the analysis of lines on a graph. Oftentimes we are looking at divergences between two lines on a graph. The implicit assumption being that those two lines should in some way converge. The gap between those two lines can be the source for all manner of explanations about the world around us.

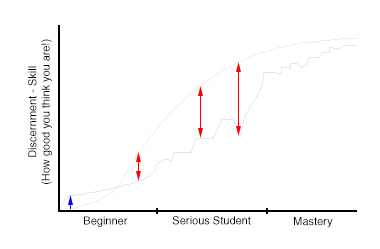

For example, in a recent post, The imposter syndrome, illustrated, I highlighted a graphic by Adam Grimes that shows the evolution of an individual’s thinking as they progress from novice to expert. This process can often leave an individual downtrodden when the recognize the divergence between our actual skills and our potential skills.

Source: Adam Grimes

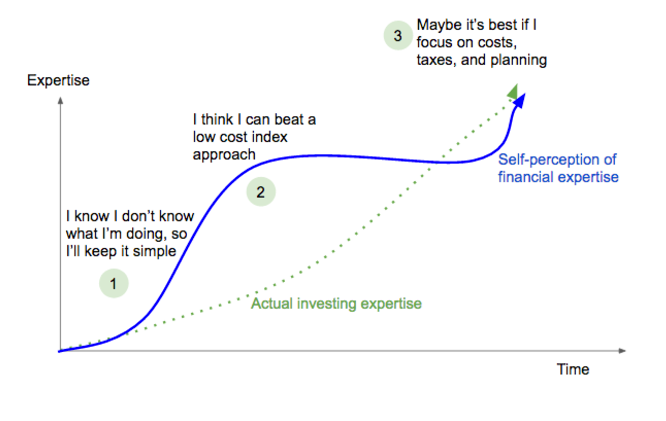

This path from novice to expert is fraught with all manner of danger. Daniel Egan in a recent post talks about the typical path an individual investor takes from raw novice to chastened veteran.

Source: Daniel Egan

Egan correctly notes that Phase 2 can be particularly dangerous to investors. He writes:

As you can see, it’s the ‘little bit of knowledge’ area where the biggest disconnect between perceived expertise and actual expertise occurs. When an investor believes they know about stocks, trading, and they have some ‘system’ that gives them confidence (or fear of losses) to more actively manage their portfolio. That’s where the biggest potential for harm exists, especially if the market has been benevolent so far.

One way to combat this knowledge gap is to be paranoid. Christopher M. Schelling writing at Institutional Investor talks about how being acutely aware of gaps in your knowledge can steel you against some bad decisions. He writes:

Any like many other cognitive biases, awareness of it is the best defense against the effects. Every time I meet a manager, I’m acutely aware with near certainty that I’m the least informed person in the room, and I’m paranoid that I’m the sucker. Thankfully, when you’re paranoid that you are the sucker at the table, you play your cards a lot tighter.

One of the reasons why gaps between our actual and perceived skills exist because we are prone to listening, and believing, available stories versus data. Morgan Housel at the Collaborative Fund writes:

While Big Data has grown, Big Anecdotes has exploded. Since the latter can be more persuasive, we’re in a weird spot where we have more statistics than ever to help us make smart decisions, but it’s also easier than ever to let stories pull us toward bad decisions.

Self-awareness is not our, that is homo sapiens, strong suit. However a measure of self-awareness is necessary to become, at the very least, a competent investor. That challenge is to come to this realization sooner rather than later and before any mistakes put you too far behind in your financial goals.