Last year I wrote a post entitled: Paper trading is obsolete. In the age of $0 equity commissions and commission-free ETFs the barriers to using real dollars to test a new or novel trading strategy are long gone. I wrote even before ‘free trading’ was a reality:

The bottom line is that traders trade. No matter how small the notional amounts involved there is no substitute for putting real money on the line.

Even the term paper trading is obsolete. All the more so in the age of cryptocurrencies. Assets that exist only in the world’s network of virtual ledgers. Let me preface this post by saying I have a tenuous grasp on the mechanics of cryptocurrencies like Bitcoin, Ethereum, Litecoin etc. That being said I own a smattering of Bitcoin (less than $100). However that small amount of Bitcoin has helped me more about this space than the average non-participant.

When describing this phenomenon I ask you to think back to the most recent edition of NCAA March Madness or the Super Bowl. Your $20 pool entry or $1 scoring square are by all accounts a rounding error in your net worth. Try to remember your emotions when your bracket got busted or the Falcons scored before the half ruining your chance at a tidy payday. Even these small stakes bring out our emotions and heighten our interest.

Think about Samuel Lee of SVRN Asset Management who was profiled by Jason Zweig in the WSJ this past weekend. Lee made an early bet on the cryptocurrency Ethereum. This small intial bet, less than 5% of his portfolio, has surged along with the value of Ethereum. Lee has a better perspective than most on speculating in cryptocurrencies. Zweig writes:

Putting only a tiny amount of his initial wealth at risk, and regarding the entire venture as an all but certain loss, have enabled Mr. Lee to keep greed from clouding his judgment — so far. “I’ve lost six figures in a matter of hours, several times,” he says. “I never lost sleep over it.”

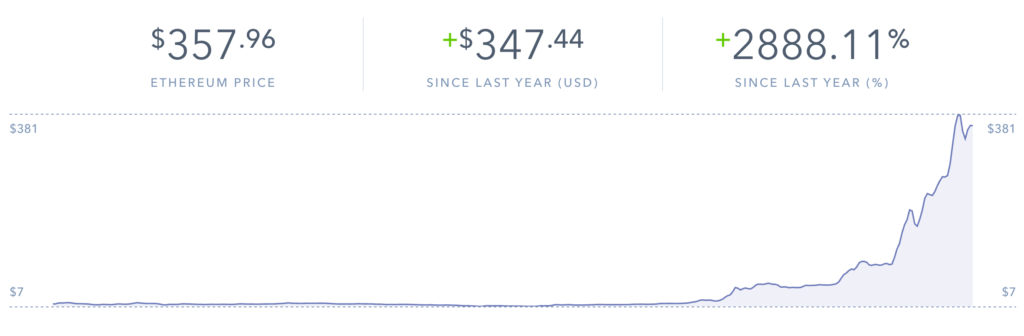

Source: Coinbase

Anyone with even a limited amount of experience in the markets would look at the chart above and would think: BUBBLE. Michael Batnick at the Irrelevant Investor thought the same thing. After thinking about he recently wrote about Bitcoin:

I no longer feel strongly that Bitcoin will cease to exist in three years, but I’m also not sure if it’s just a twenty-first century bubble either.

As I noted earlier those people with their toes dipped in the cryptocurrency pool will have a front row seat for what happens next and will have the incentive to learn what is going on. Those sitting on the sidelines will be hamstrung by hindsight bias. The great thing is that in many of today’s financial markets you no longer need much in the way of capital to get started. Howard Lindzon writes:

Sometimes you just have to participate because just doing that puts you ahead of 99 percent of the people.

To be clear I have no idea what will happen to the cryptocurrency universe. Like Michael Batnick it is increasingly more difficult to think the major alt-currencies will simply vanish but trying to put some sort of valuation on them is an exercise in futility. That being said my tiny fraction of a Bitcoin is going to keep me watching (and learning).

For more information about the growing cryptocurrency phenomenon check out this podcast with Joe Weisenthal and Tracy Alloway of Bloomberg talking with Chris Burniske of Ark Invest.