Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at why covered interest rate parity has broken down.

Chart of the Day

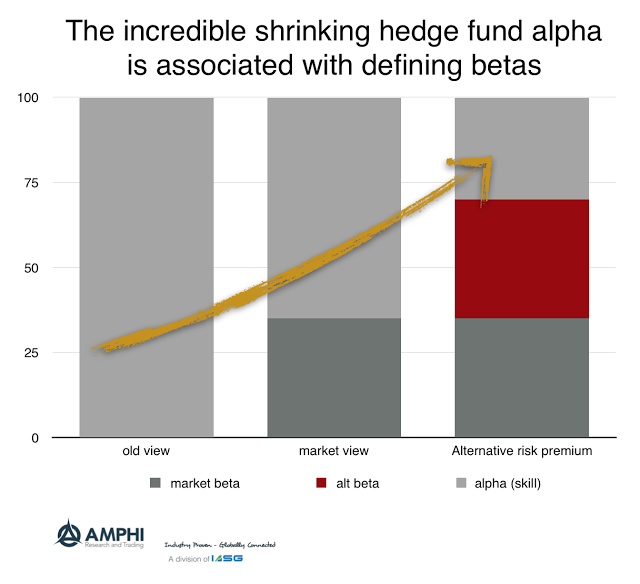

Is all the talk about shrinking alphas a function of definitions?

Factors

- What do random factor portfolios tell us about how easy it is to beat the market? (capitalspectator.com)

- Why do factors seem more potent when applied to a micro-cap universe? (factorinvestor.com)

- Growth is not the opposite of value. (researchaffiliates.com)

- Why don't we see more work on carry? (cantabcapital.com)

- Trend following has worked for a long time. (medium.com)

Research

- The $VIX has little in the way of predictive value. (aqr.com)

- More evidence that the state of (Fed) monetary policy affects the stock market. (papers.ssrn.com)

- The case for commodities is diversification. (gersteinfisher.com)

- Net issuance is bad for returns. (etf.com)

- Post-2009 acquisitions are no longer a value-killer for public companies. (sciencedirect.com)

- Some research that shows PE is not as short-term oriented than commonly thought. (bloomberg.com)