Much of what you see in the financial media is focused on there and now. If you are lucky it may concern tomorrow as well. This commentary largely adds up to nothing, i.e. noise. There are however some long-term trends, like demographics, that are relatively easy to project out years, if not decades. Rick Bookstaber says in a recent post:

In fact, ironically, the issues that extend to the long term are in some ways more predictable than those of the shorter term. Things like demographics, changes in demand due to the adoption of new technology, fixed income of retirement, and, unfortunately, climate change.

One investment trend I would put into that camp is socially responsible or ESG investing. There are a number of reasons for this but suffice it to say the trends are all moving in one direction. From a Chris Taylor piece in Fortune:

“This field is global in nature and has a tremendous amount of momentum,” says Jon Hale, director of sustainable investing research at Chicago-based Morningstar. “In some ways, the election has actually galvanized ESG investors.”

Millennials and younger generations are particularly drawn toward this type of investing. As they save and inherit capital they will help accelerate the trend. Some argue the acceleration in in interest in sustainable investing is driven by the results of the most recent Presidential election. Josh Brown at the Reformed Broker writes:

There is a massive movement underway being driven almost entirely by the desire of the end-investors to have a portfolio that is in sync with their values…The investment industry is responding to this desire, albeit perhaps not fast enough, but it is happening.

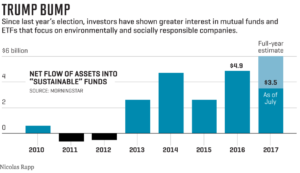

From the chart below you see that there has been a pick up in interest in ESG-related funds. As awareness continues to grow and ESG investment options become more available in retirement accounts we should see even bigger AUM numbers. That is why Morningstar purchased a 40% stake in ESG rating firm Sustainalytics and Impax Asset Management is buying Pax World Management.

All that being said there are some practical considerations to keep in mind when going down the ESG road. Even with better ESG-related ETFs it is still a little tricky. Dave Nadig at ETF.com notes two potential downsides. He writes:

Not only do most of these [ESG] ETFs cost substantially more, some of them start entering the realm of being tricky to trade…I’m quite confident that as ESG investing continues to catch on, more ETFs will have the liquidity and the track record to make their efforts even more meaningful.

Nadig is correct that investors need to do their homework. Applying an ESG component to your portfolio increases the complexity of the process. That being said there is some research that shows that ESG can have some positive benefits when investing.

For example, a recent paper shows that investment professionals are more willing to recommend an investment in a company if it voluntarily makes positive disclosures on the corporate social responsibility (CSR) front. Other research shows that ESG disclosures can help fine-tune risk assessments above and beyond those found on the income statement and balance sheet.

Maybe the most interest piece of recent out by David Blitz and Frank J. Fabozzi entitled “Sin Stocks Revisited: Resolving the Sin Stock Anomaly.” For a long time it was believed that due to higher discounts rates that so-called sin-stocks have/had higher expected returns. Indeed this is what would expect if investors screened out companies with undesirable characteristics.

However Blitz and Fabozzi find that after applying a factor-based approach to ‘sin stocks’ they find that their higher returns are subsumed by more complete factor models. In short, sin stocks outperformed because their factor loadings had been in favor. This conclusion allows ESG investors who move beyond a simple screening process to create ESG portfolios that have a more balanced factor profile. They write:

However, now that it is clear where this performance loss is coming from, it is also clear what investors may do about this. Given that we can trace the outperformance of sin stocks to exposures to certain factors, investors may restore their portfolios’ expected return by making sure that the portfolios’ factor exposures do not deteriorate when excluding sin stocks. For example, investors could increase the weights of stocks that are able to compensate for the loss in factor exposures that results from excluding sin stocks—that is, by investing more in non-sin stocks that have exposures to the same factors that drive sin stock returns.

That being said ESG isn’t all about performance. In fact, those investors who say you can definitely have your ESG (cake) and eat it (returns) too are likely overstating the case. Cliff Asness at AQR thinks ESG investors should be willing (and have to) sacrifice returns in order to follow their conscience. He writes:

Frankly, it sucks that the virtuous have to accept a lower expected return to do good, and perhaps sucks even more that they have to accept the sinful getting a higher one. Well, embrace the suck as without it there is no effect on the world, no good deed done at all. Perhaps this necessary sacrifice is why it’s called “virtue.”

Ever since the end of the global financial crisis, the cost-matters hypothesis has been the primary driver of fund flows. However, there is only so far fund fees can fall. That leaves an opening for qualitative factors, like ESG, to take the stage. There is no perfect solution yet for ESG investing, therefore ‘going social’ will continue to require additional work. The good news is that the tools, both analytical and fund-related, are only going to get better.

It’s okay to have non-financial wants for your portfolio. Especially if it helps motivate you to invest in the first place, and stick with it during periods of market stress. In the end, it is your choice how to proceed. Just remember, it’s YOUR money. Do as you see fit.

*On the origin of the phrase “perfect is the enemy of good.”