Our attention is all we have. Who and what we pay attention to help define who we are and how we think. As Faris at ART+marketing writes:

What you think is a function of the ideas you consume… The better, more diverse the inputs, the better the ideas because ideas are new combinations and the more diverse the inputs that are held together by the combination, the more interesting the idea is. This is the hybrid vigor of creativity.

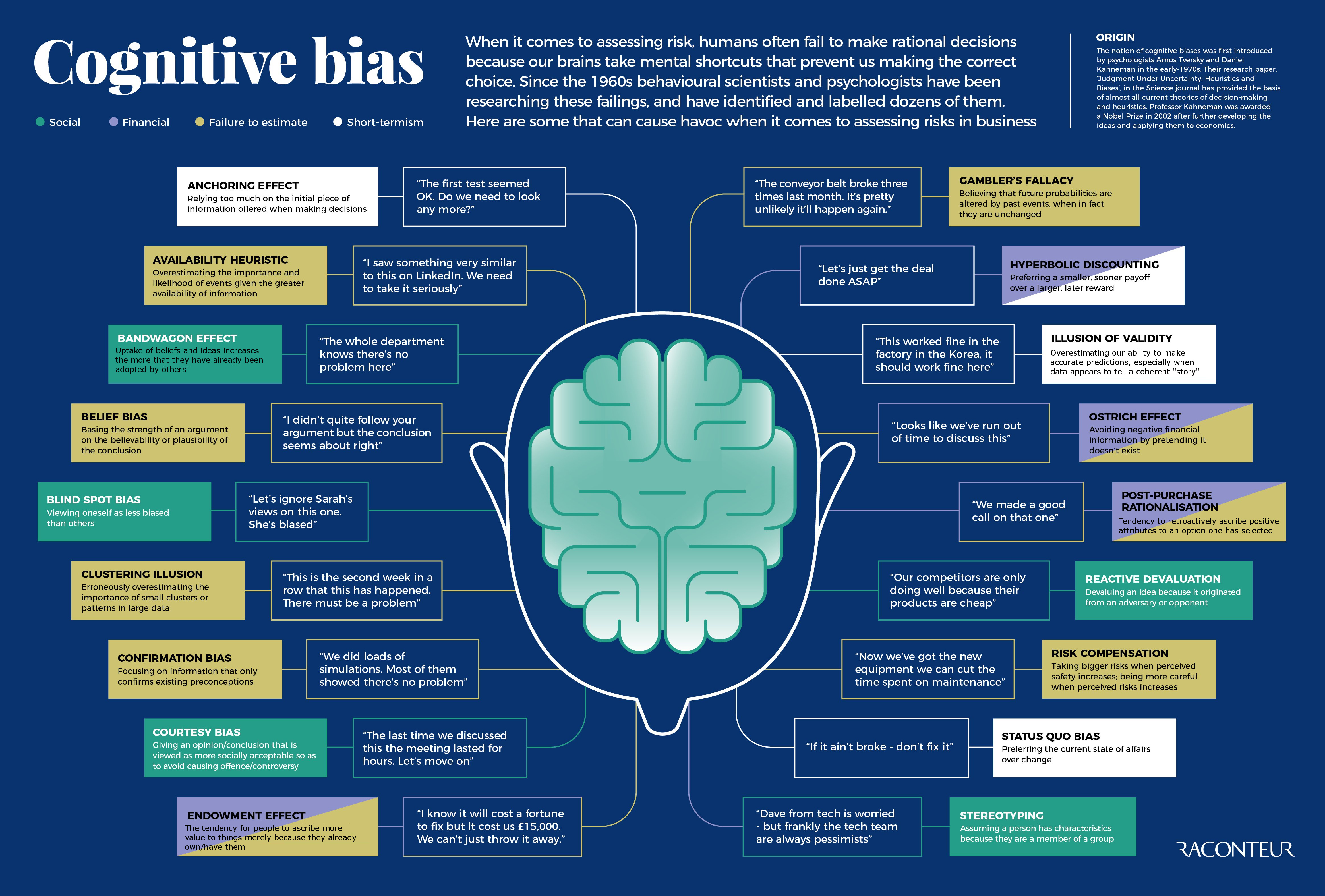

The problem is that we humans are a cognitively lazy lot. Brains use a lot of energy and we look for cognitive shortcuts. Diverse inputs require us to overcome firmly entrenched hardwired behavior. Many of our behavioral biases have evolved because they allowed us to not have to think too long or hard.

Diversity is certainly important when it comes to creating new ideas. The problem today is that diversity can be squelched without us knowing it by the algorithms of large corporations or they are simply drowned out in the flood of news, media and notifications we all receive. You can try like this man in Ohio to studiously avoid the news or you can try to only get your news offline like this New York Times columnist. Neither solutions really works.

We all want to avoid reading (or spreading) fake news. However a bigger problem for consumers isn’t fake news but empty news. Anyone contemplating going on a diet hears about avoiding ’empty calories.’ The same is true with news as well. This story that translates Jeff Bezos’ change in net worth into an hourly figure is devoid of any useful information. We all understand that stock prices go up and down. It’s not clear why we need to track the net worth of billionaires on a daily basis. These billionaires don’t.

Some days it seems like putting your head in sand is the optimal solution. However, cutting yourself off from the world is not an option for those in the financial industry who have to have some sense for the market environment even if they don’t plan on acting on that information in the moment. Not all is lost.

The world of blogs continues to be a fruitful area for financial professionals to continue to look for content. Many Americans have to a large degree turned off financial television. There is still good stuff in the mainstream press, you just have to look a little harder to find it. Which is kind of the point. You either have to know what to look for or trust someone else to do it for you.

The standard you to ask about any source: blog, book, newspaper, TV show, Twitter feed etc. is whether it is making your life better. As Seth Godin writes:

The reviews and the comments and the breaking news and the texts that you read are all coming directly into the place you live. If they’re not making things better, why let them in?

Godin’s argument is about being mindful about your attention. It’s about choosing who (and what) you let into your daily life. Maura Thomas at HBR puts it like this:

Practicing attention management will not eliminate distractions from your day. But as you start to recognize when you become distracted, and build your “attention muscle” through habits like those above, you’ll start to reclaim your life and devote more of yourself to what’s really important to you.

What’s important to you is different than what is important to some one else. And that’s okay. What’s not okay is allowing algorithms, our cognitive biases or bad habits hijack your attention.