Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at how mutual fund portfolio managers are compensated.

Quote of the Day

"We see a bubble in the US stock market today, albeit less extravagant than Tesla or the growing swarm of cryptocurrencies. Reasonable observers can disagree, but we believe we are experiencing a tech bubble, based on our relatively rigorous definition of the term."

(Rob Arnott, Shane Shepherd and Bradford Cornell)

Chart of the Day

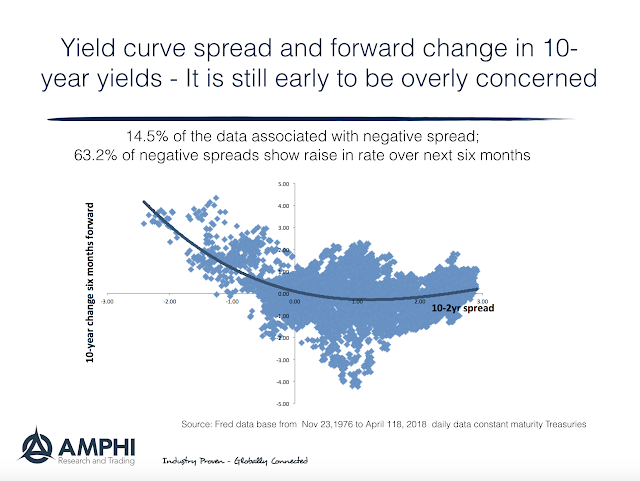

What does the slope of the yield curve tell us about future changes in rates?

Value

- Can the price-to-book ratio be fixed? (osam.com)

- Value strategies are not necessarily tax-efficient. (factorresearch.com)

Behavior

- Have the findings on loss aversion been overstated? (link.springer.com)

- Is risk taking capacity a function of nature or nurture? The answer is both. (mrzepczynski.blogspot.com)

- The disposition effect doesn't operate in isolation. (etf.com)

Research

- Research shows bond investors have a tendency to 'reach for yield' to their detriment. (alphaarchitect.com)

- The VIX complex has grown far beyond its original conception. (bankunderground.co.uk)

- Nassim Taleb on the problem of spurious correlations in the age of 'big data.' (wired.com)

- Retirement accounts are valuable, the question is how much? (alphaarchitect.com)