Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at mean reversion in bond ETF returns.

Chart of the Day

It’s hard to find much evidence in favor of liquid alternative funds.

Research links

- Research shows that real-life trading costs are lower than those assumed in academic papers. (papers.ssrn.com)

- The number of US-listed companies is down but the US public company is in decent shape. (papers.ssrn.com)

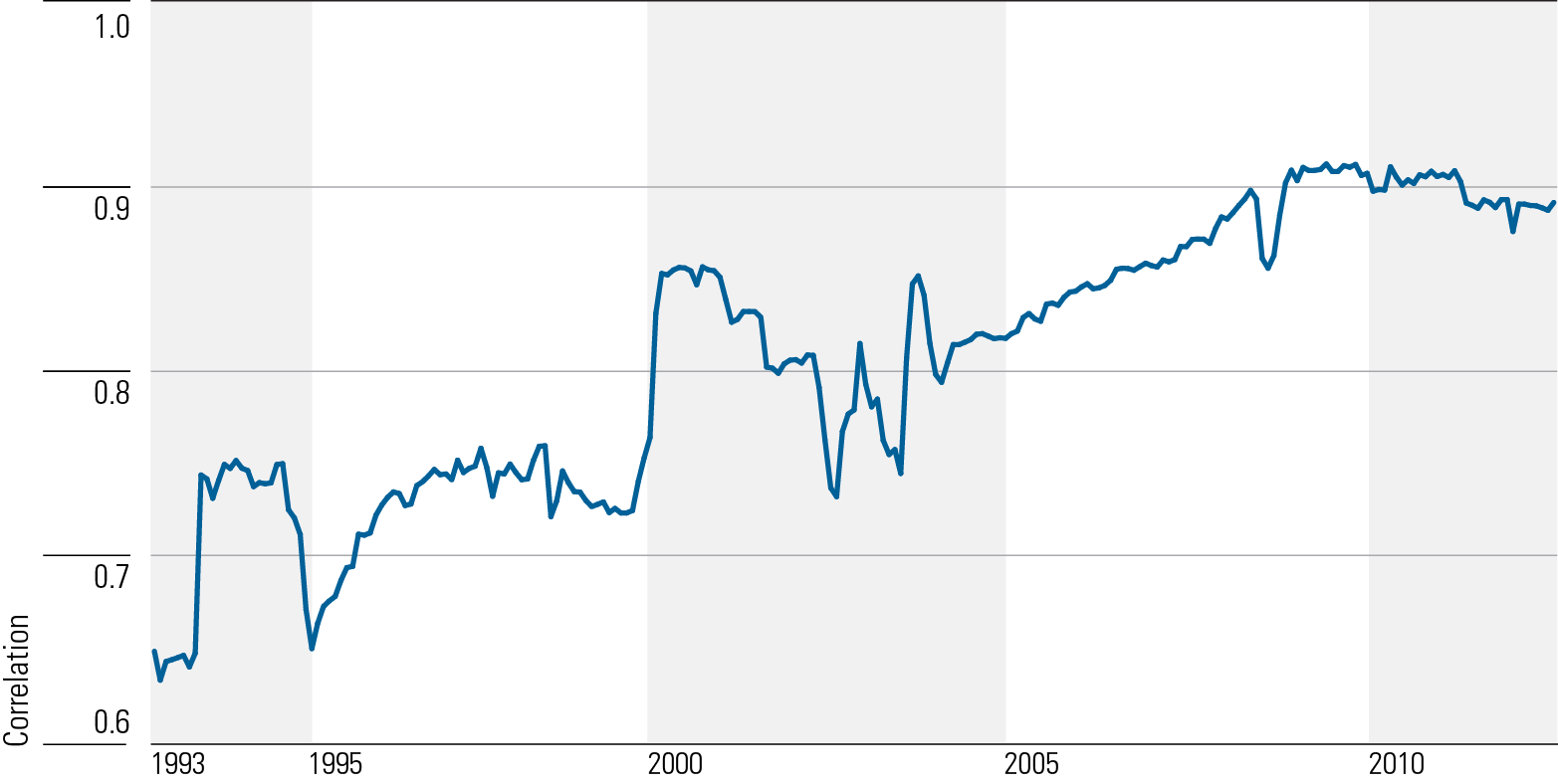

- The correlation between stocks and bonds is regime dependent. (alphaarchitect.com)

- The systematic case for high beta stocks is pretty weak. (fortunefinancialadvisors.com)

- The case for the carry factor is underplayed. (alphaarchitect.com)

- How smart beta ETFs stack up relative to their mutual fund counterparts, i.e. value vs. value. (factorresearch.com)

- What business schools teach does have an impact in the real world, but it takes some time. (hbr.org)