Subscribe! Want to stay up-to-date with all of our posts? Sign up for our daily e-mail newsletter and get all the good stuff when it comes out.

Quote of the Day

"All investing comes back to arbitraging human nature. Why? Because it’s in your nature to sell during a panic. It’s in your nature to buy when everyone else is buying. It’s in your nature to make every behavioral mistake that exists out there."

(Nick Maggiulli)

Chart of the Day

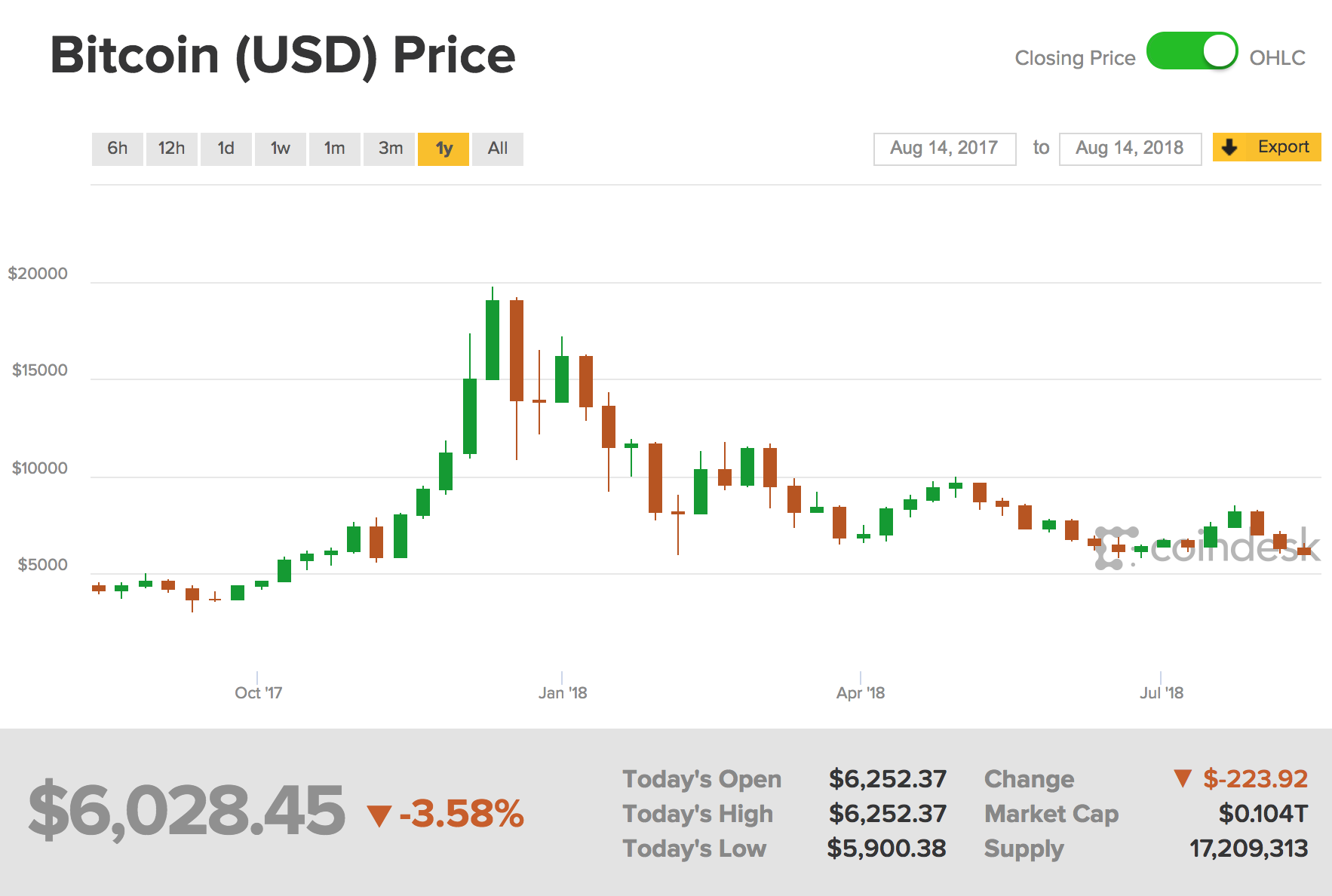

Brad Feld, “Capitulation in markets is one of those endless lessons that gets learned over and over and over again.” (chart via CoinDesk)

Strategy

- Predicting the next systemic crisis has become de rigueur. (ftalphaville.ft.com)

- Alternative risk premia don't stay static over time. (mrzepczynski.blogspot.com)

Behavior

- Collectibles are uniquely at-risk of survivorship bias. (ritholtz.com)

- How looking at a portfolio more often can make it seem riskier. (albertbridgecapital.com)

- How to offset optimism bias. (evidenceinvestor.co.uk)

Support

- Stay up-to-date with all of our posts: sign-up for our daily e-mail. (abnormalreturns.com)

- Love Abnormal Returns? Then like (and follow) us on Facebook. (facebook.com)

Finance

- Symphony is making headway against Bloomberg, albeit slowly and without much revenue. (businessinsider.com)

- Will Twitter ($TWTR) ever be the appropriate forum to disseminate corporate news? (nytimes.com)

- Fintech startups are diving into the subprime credit space. (wsj.com)

Funds

- Active investors have not shown any systematic ability to sidestep bubbles. (behaviouralinvestment.com)

- The ETF Deathwatch for July 2018. (investwithanedge.com)

Emerging markets

- Buy the crisis, sell the whatever. (marketwatch.com)

- Turkey's crisis is of its own making. (ftalphaville.ft.com)

Economy

Earlier on Abnormal Returns

- Research links: liquid disappointments. (abnormalreturns.com)

- What you missed in our Monday linkfest. (abnormalreturns.com)

- Adviser links: meaningful selections. (abnormalreturns.com)