Want to stay up-to-date with all of our posts? Sign up for our daily e-mail newsletter and get all the good stuff when it comes out.

Quote of the Day

"It helps to think of stocks as having a focal length, like the lens of a camera, which is the point in the future investors are looking at."

(Andy Kessler)

Chart of the Day

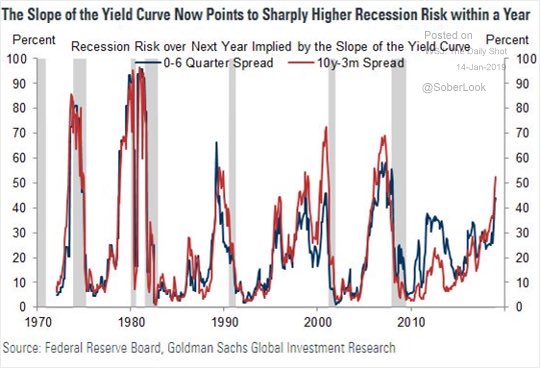

If you think the yield curve is a still a viable measure of recession risk, here you go… (GS via @lizannsonders)

Markets

Strategy

- Mark Rzepczynski, "Some information is useful but not meaningful." (mrzepczynski.blogspot.com)

- "Why do so many bottom-up managers dabble in macro tourism?" (demonetizedblog.com)

Companies

- Newmont ($NEM) is buying Goldcorp. (bnnbloomberg.ca)

- Beware the mega-merger (in a declining industry). (crossingwallstreet.com)

Finance

- On the prospects for scandal-plagued Wells Fargo ($WFC) going forward. (ft.com)

- Bankers dress differently depending on which part of the country they do business. (wsj.com)

ETFs

- A look at how much revenue ETFs generate for the big asset managers. (etf.com)

- The ETF Deathwatch for December 2018. (investwithanedge.com)

- These ETFs had good years in 2018, asset gathering wise. (etf.com)

Economy

- From the wayback file, a look at the 'scariest jobs chart ever.' (ft.com)

- The government shutdown is preventing small business loans from closing. (washingtonpost.com)

Earlier on Abnormal Returns

- Adviser links: decumulation difficulties. (abnormalreturns.com)

- What you missed in our Sunday linkfest. (abnormalreturns.com)

- Top clicks last week on the site. (abnormalreturns.com)