Want to stay up-to-date with all of our posts? Sign up for our daily e-mail newsletter and get all the good stuff when it comes out.

Quote of the Day

"Try going back to some simple filters when it feels like you are overcome with information overload. You may not make more money but in the end time is your most valuable currency."

(Howard Lindzon)

Chart of the Day

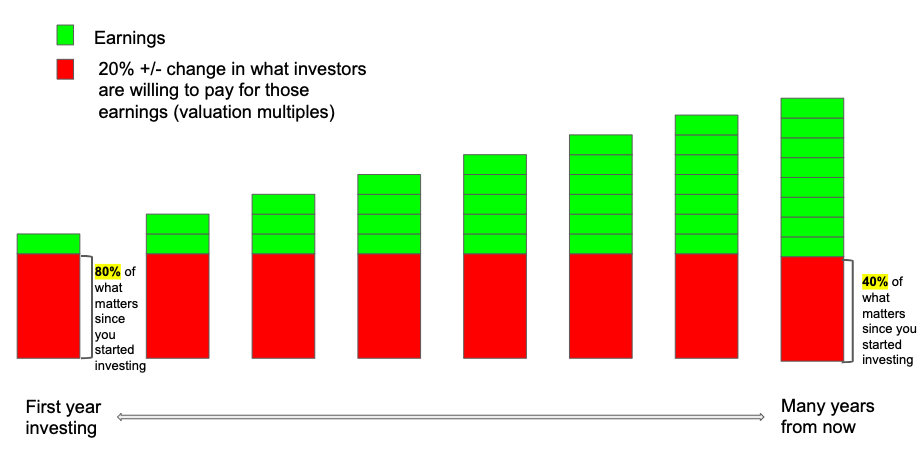

“When earnings compound over time but changes in valuation multiples don’t, the importance of changes in valuation multiples to your lifetime returns diminishes.”

Markets

Strategy

- The stock market's worst (and best) days happen more often below the 200 day moving average. (theirrelevantinvestor.com)

- The time to reassess your risk tolerance isn't during a big drawdown. (awealthofcommonsense.com)

- Why financial television is mostly 'worthless noise.' (evidenceinvestor.com)

Funds

- The best investment teams are not dominated by a superstar. (institutionalinvestor.com)

- Investors are demanding additional data on manager diversity. (opalesque.com)

- It would be great if somehow we could get 'integrity' data on companies and managers. (blogs.cfainstitute.org)

Economy

- Rail loadings were strong in January. (calculatedriskblog.com)

- Some tentative results from a Finnish test of UBI. (fortune.com)

- In praise of 2% inflation. (ft.com)

Earlier on Abnormal Returns

- Podcast links: long-form pros. (abnormalreturns.com)

- What you missed in our Thursday linkfest. (abnormalreturns.com)

- Startup links: aging unicorns. (abnormalreturns.com)

- Q&A with Jacob Taylor author of "The Rebel Allocator." (abnormalreturns.com)

- Q&A with Brent Beshore author of “The Messy Marketplace: Selling Your Business in a World of Imperfect Buyers.” (abnormalreturns.com)

- Ten charts that demonstrate investing is hard. (abnormalreturns.com)